Japan is facing a demographic reality that many developed nations are watching closely: a rapidly aging population. As of 2024, according to Japan’s Ministry of Internal Affairs and Communications, nearly 30% of the population is over the age of 65. This demographic shift drives soaring demand for life insurance, not just to secure financial protection for families, but also to offset healthcare and elder care costs.

Yet, as this demand grows, so do operational costs for insurers, particularly in labor-intensive areas such as underwriting, customer service, and claims processing, processes that traditionally rely on paper documentation and manual workflows. On top of this, modern customers expect faster, more personalized services, delivered digitally.

To meet these challenges, artificial intelligence – AI ln Life Insurance has become a strategic pillar for companies in Japan, reshaping business models and redefining customer experience in unprecedented ways.

Japan’s Life Insurance Market: A Global Leader Under Increasing Pressure

Japan is home to one of the most mature and high-penetration life insurance markets in the world. As of 2023, over 90% of Japanese adults own at least one life insurance policy, with many holding multiple policies to cover different aspects of financial security, medical expenses, and end-of-life planning. The industry’s total market size is estimated at USD 3.9 trillion, making it a global leader in both scale and market sophistication (Swiss Re Institute, 2023).

Yet behind these impressive numbers lies a system under significant strain. Japan’s demographic challenge is unique; nearly 30% of its population is over 65 years old, one of the highest ratios globally. This means insurers are not only managing a growing volume of policies for an aging customer base but also dealing with increasingly complex medical histories, higher claim rates, and mounting operational costs.

Traditionally, Japan’s life insurance processes have been heavily paper-based and manual, reflecting a conservative approach to risk assessment and regulatory compliance. Underwriting decisions typically involve in-depth reviews of physical documents, medical records, and extensive risk profiling, a process that can take anywhere from several days to over a week, especially for elderly policyholders or those with pre-existing conditions.

Similarly, claims management has relied on manual document verification, medical certificate reviews, and human-led fraud investigations, leading to long processing times and inconsistent customer experiences.

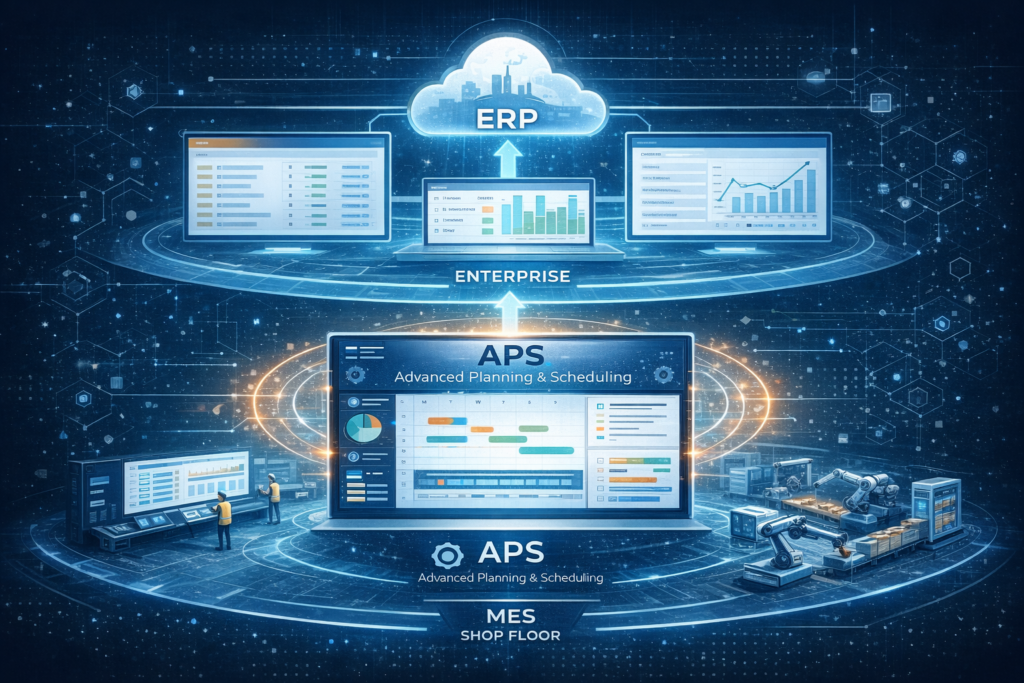

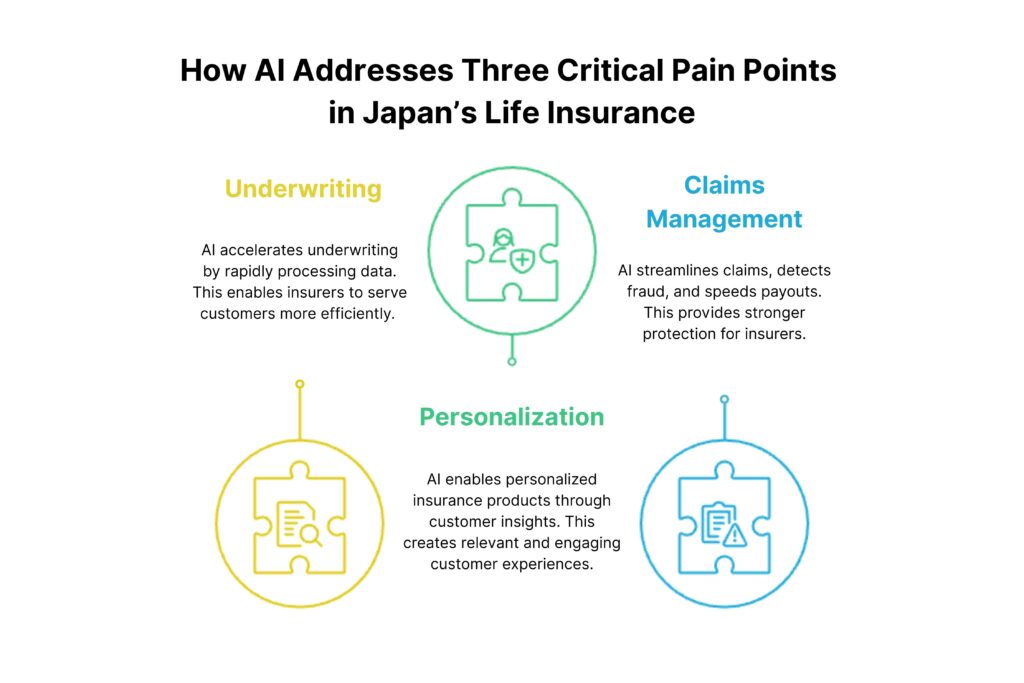

In response to these growing operational pressures, many Japanese life insurers have begun integrating artificial intelligence (AI) into their core processes. AI in life insurance is being strategically deployed to address three critical pain points in the market:

Accelerating Underwriting Processes

AI is transforming underwriting from a slow, manual task into a swift, intelligent process. It reads through medical records, deciphers health data from wearables, and interprets risk histories within seconds, giving insurers the speed and precision they need to serve customers better.

Personalizing Products and Services

Gone are the days of one-size-fits-all policies. AI unlocks deep, meaningful insights about each customer, their lifestyle, health trends, and life milestones. Insurers can now design protection plans and health programs that feel made-to-measure, creating a more relevant and engaging customer experience.

Streamlining Claims Management and Detecting Fraud

AI is taking the weight off claims teams by handling tedious document checks and information verification. At the same time, advanced machine learning models stay alert, spotting unusual patterns and uncovering fraud attempts that human eyes might miss. The result is faster payouts for genuine claims and stronger protection for insurers.

How AI in Life Insurance Is Powering the Next Chapter in Japan

Faster, More Accurate Underwriting with AI

Previously, underwriting a standard life insurance policy in Japan could take 3–7 days, due to the need to review medical records, consult with hospitals, and evaluate multiple risk factors.

Since implementing AI-powered underwriting systems, companies like Sompo Himawari Life have slashed this turnaround to just one hour for most policies. AI solutions:

- Analyze electronic medical records (EMRs)

- Cross-check medical history and health screening results

- Integrate wearable device data (with consent) to refine risk profiling

This has reduced reliance on manual labor, minimized human error, and allowed insurers to handle rising case volumes swiftly, a necessity in an aging society.

AI-Powered Customer Service and Contract Management

Life insurers in Japan are increasingly adopting AI-driven chatbots to reshape customer service. These smart systems are capable of answering policy questions, explaining the claims process, and offering product recommendations, all day, every day. Customers can now get the information they need in an instant, without waiting in long queues or navigating complex phone menus.

What makes these AI chatbots stand out is their ability to communicate naturally in Japanese, especially catering to Japan’s older population. Since more than 35% of life insurance clients are aged 60 and above, having a system that speaks in a familiar, respectful tone is crucial. These chatbots can provide support tailored to this demographic, making the experience feel personal, without losing the efficiency of automation.

In the long run, AI-powered chatbots are helping insurers reduce operating costs while improving customer satisfaction. For customers, this means faster service and a more accessible experience, especially outside regular business hours. For insurers, it translates into more effective use of resources and the ability to scale services to meet future demands.

Faster Claims Processing with AI

For years, claims assessment in life insurance meant slow, manual document reviews and heavy paperwork. In Japan’s aging society, with rising claim volumes, this posed growing operational challenges.

That’s beginning to change. Major Japanese insurers, including MS&AD Insurance Group, are embracing AI-powered solutions to completely rethink how claims are handled. These systems integrate Optical Character Recognition (OCR) technology with Natural Language Processing (NLP) to quickly scan, extract, and interpret information from various claim documents, whether scanned images, PDFs, or handwritten forms.

The result:

- Claims reviewed in under 1 minute

- AI-driven fraud detection using machine learning models

- Average payout times reduced to under 24 hours

Using AI to Prevent Health Issues and Lower Premiums

Instead of just reacting to health problems, Japanese insurers are taking a proactive approach, using AI to monitor policyholders’ health and even adjust premiums based on healthier lifestyles.

- Early Detection of Health Risks: Insurers are using data from wearables like fitness trackers and smartwatches to identify early signs of health issues. AI helps spot potential risks, allowing customers to make healthier choices before problems arise.

- Incentivizing Healthy Lifestyles: To encourage better habits, some insurers are offering lower premiums to customers who stay active or reach specific health goals. It’s a win for both sides, as customers save money and insurers lower future risk.

- Personalized Health Guidance: AI analyzes data from wearables and health checkups to provide tailored health advice. This personalized approach ensures each customer receives guidance suited to their unique health needs, improving overall well-being.

Read more: Generative AI in Healthcare: Transforming Care with Intelligence That Creates

Looking Ahead: The Future of AI in Life Insurance

AI-Driven Premium Growth

Forecasts from Deloitte suggest AI-focused insurance products could generate $4.7 billion in annual global premiums by 2032. Unlike conventional policies, these offerings will adapt to people’s daily habits, health data, and financial behaviors. Insurers are moving toward products that react to life as it happens, adjusting coverage terms, pricing, and risk scoring in near real-time

Embedded Insurance Going Mainstream

Embedded insurance, coverage bundled naturally into purchases or services, is gaining serious traction. It’s projected to top $722 billion globally by 2030. In life insurance, that might look like temporary coverage offered during high-risk life moments (think travel, surgeries, or major purchases) or on-demand micro-policies triggered by wearables and health apps. AI will quietly drive the back-end, making split-second decisions on eligibility, pricing, and policy terms.

Tighter AI Oversight

AI’s growing influence has regulators paying attention. As of March 2025, 24 U.S. states had already adopted official guidelines on AI use in insurance, emphasizing fairness, transparency, and accountability. Similar policies are under development in Japan, the EU, and other regions. In the years ahead, life insurers won’t just compete on digital convenience, they’ll be judged on how ethically and responsibly they manage AI-powered decisions.

Conclusion

Life insurance has always been about people, about safeguarding futures, easing worries, and standing by families when it matters most. What’s changing isn’t the heart of that promise, but the tools we now have to deliver it. AI in life insurance is giving insurers smarter, faster, and more intuitive ways to listen, respond, and care for their customers.

The future of life insurance will belong to those who can pair advanced technology with empathy, creating protection that feels personal, timely, and effortless at scale.

That’s the future VTI helps insurers build. Contact us now and be part of the future shaping life insurance for the better.

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)