“A modern POS system can be your best employee—if you know how to use it right.” It’s a busy Saturday afternoon at Tanaka-san’s electronics store in Tokyo. The queue is growing longer, customers are checking their watches, and his newest cashier is frantically pressing buttons on the POS terminal, sweat beading on her forehead. “The scanner won’t work!” she calls out desperately. This scene plays out in countless businesses every day. But it doesn’t have to be your story since this blog will provide a practical resource for staff and owners to maximize the efficiency of POS payments.

Why Does POS Payment Mastery Matter?

POS at the Core of Daily Operations

In today’s retail and hospitality landscape, your Point of Sale system isn’t just a fancy cash register—it’s the nervous system of your entire operation. From processing pos payment transactions to managing inventory and collecting customer data, a well-operated POS system can transform your business efficiency.

Take Singapore’s thriving restaurant scene, where successful establishments rely on their all in one pos system to handle everything from tableside ordering to kitchen communications. The difference between a smooth operation and chaos often comes down to one thing: how well your team knows their POS terminal.

Common Pain Points That Keep Business Owners Awake

Every business owner in Malaysia, Thailand, Vietnam, and across the region faces similar challenges:

Staff are struggling with technology because complex interfaces weren’t properly explained during training. New employees often feel overwhelmed, leading to mistakes and frustrated customers.

Long queues during peak hours are caused by POS errors or slow transaction processing. In competitive markets like Seoul or Bangkok, customers won’t wait—they’ll simply go elsewhere.

Data inconsistencies occur when systems don’t sync properly, leaving you with inaccurate inventory counts and unreliable reports for business decisions.

Benefits of POS Payment Proficiency

But here’s the exciting part: Businesses that master their POS payment systems see remarkable improvements:

Faster checkouts that can process 30% more customers during peak hours, directly boosting revenue without additional overhead.

Fewer transaction errors mean happier customers and reduced losses from processing mistakes.

Real-time inventory updates through your pos inventory system enable smarter stock management, preventing both shortages and overstock situations.

Enhanced customer satisfaction through personalized service and automated loyalty programs that make every visitor feel valued.

Understanding Your POS Payment System: A Quick Overview

Think of your POS system like a car—you don’t need to be a mechanic to drive effectively, but understanding the basic components helps you operate with confidence. A complete POS Payment System includes 2 core components:

POS Hardware Components: Touchscreen Terminal, Barcode Scanner, Receipt Printer, Cash Drawer, Card Reader, and NFC Terminal

POS Software Capabilities: Sales Tracking, POS Inventory Management, CRM Tools; Integration Capabilities: Connect with your invoice management software, accounting systems, and eCommerce platforms for seamless business management.

Cloud vs. On-Premise POS Systems

Cloud-based POS: Like having your business data stored in a secure digital vault accessible from anywhere. Lower upfront costs and automatic updates, but requires stable internet connectivity.

On-premise POS: Like having your own private server room. More control and offline functionality, but higher initial investment and maintenance requirements.

Popular solutions include Square for small businesses, Shopify for retail, Lightspeed for restaurants, and Odoo for enterprises needing comprehensive pos erp system functionality.

Cloud and On-Premise POS are 2 common categories of POS System; however, POS types can also be divided into more types, regarding deployment or functionality.

Setup & Optimization for Maximum Efficiency

Remember Tanaka-san from our opening story? After implementing these setup strategies, his store now processes customers 40% faster, and his staff feels confident in every transaction with POS payment.

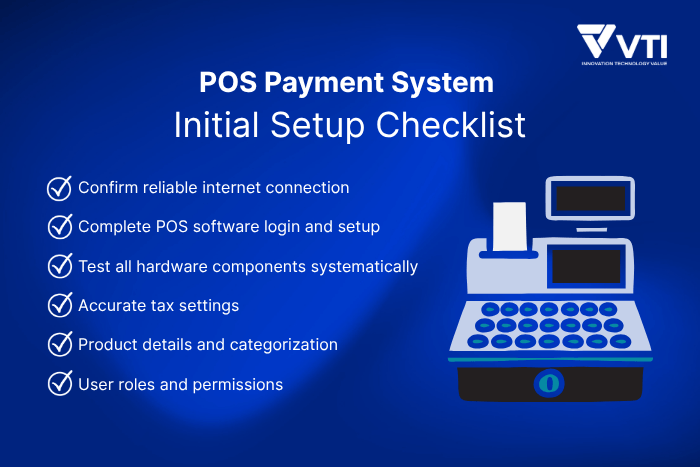

Initial Setup Checklist

Noticeable steps to start setting up a POS Payment System

Confirm a reliable internet connection for cloud-based systems. In areas with intermittent connectivity, consider hybrid solutions that work offline and sync when connected.

Complete POS software login and setup with your business information, tax settings, and initial product catalog.

Test all hardware components systematically. Run test transactions, print sample receipts, and scan various barcode types to ensure everything communicates properly.

Accurate tax settings are crucial, especially in Asia-Pacific countries where consumption tax applies differently to various product categories.

Product details and categorization make navigation intuitive. Group similar items together and use clear, descriptive names your staff will recognize instantly.

User roles and permissions are based on staff responsibilities. Cashiers need transaction access, while managers require reporting and adjustment capabilities.

Optimization for Maximum Efficiency

Choosing a Suitable Software Development Programming Language

The choice of programming language directly impacts system performance, scalability, and maintenance efficiency:

| Platform | Recommended Languages | Key Benefits |

| Windows-based | C#, C++, Java | Native performance, enterprise integration |

| Cross-platform | Java, Python, JavaScript | Flexibility, extensive libraries |

| Mobile (iOS) | Swift, React Native | Native mobile experience |

| Web-based | JavaScript, PHP, Python | Universal accessibility |

A user-friendly and customized POS payment system could be built in multiple languages. For example, Odoo’s backend is mainly written in Python, making it easy to extend or customize, while the frontend utilizes XML, JavaScript, and QWeb for a seamless user experience.

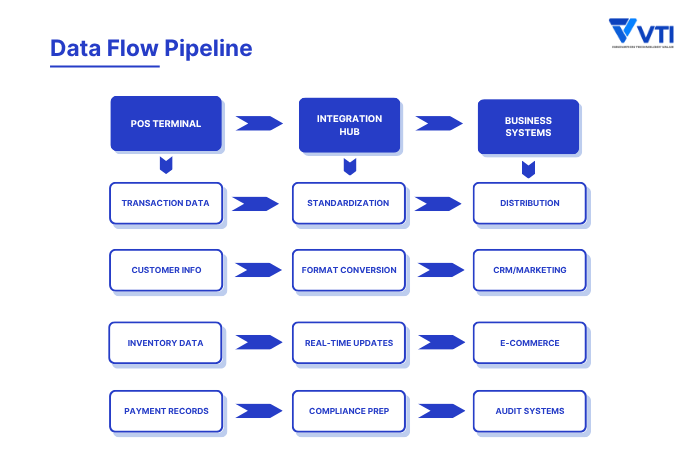

System Integration Strategy

Integrating Payment Functions with Other POS Features (CRM, Auditing, and E-commerce): By integrating all these systems simultaneously, businesses achieve a comprehensive unified data ecosystem where payment, customer management, inventory, and financial reporting operate in harmony. This leads to improved accuracy, operational efficiency, and enhanced POS customer service:

Integration Benefits Matrix

| System Integration | Data Exchange | Business Impact |

| POS ↔ CRM | Customer profiles, purchase history | Personalized marketing, loyalty programs |

| POS ↔ E-commerce | Inventory levels, order status | Real-time stock synchronization |

| POS ↔ Auditing | Transaction records, financial data | Automated compliance reporting |

| POS ↔ Analytics | Sales patterns, performance metrics | Data-driven business decisions |

Operational Efficiency Accelerators

Time-Saving Implementation Strategies:

- Keyboard Shortcuts: Custom hotkeys for frequent actions (typical savings: 3-5 seconds per transaction)

- Process Automation: Automated receipt preferences, inventory alerts, end-of-day procedures

- Smart Interface Design: Prominent placement of high-volume items for rapid selection

Customizing the POS System

Customizable POS software allows businesses to fine-tune features like inventory management, reporting, customer engagement, and workflow automation to fit their specific requirements rather than relying on a one-size-fits-all solution.

Important considerations when customizing a POS system:

- Specific Business Requirements: Understand your industry-specific needs, customer expectations, and operational workflows

- Scalability: Choose a system that can grow with your business.

- Ease of Use: The system should be user-friendly for employees and customers.

- Integrations: Ensure compatibility with existing software like accounting or marketing tools.

- Technical Support: Reliable vendor support is essential for maintenance and troubleshooting

Businesses can optimize their POS payment system by selecting a customized solution that covers all essential needs and can scale effectively as the number of stores grows. The POS system evolves from managing a single store to a central dashboard that oversees all stores simultaneously. This allows you to:

- View sales, inventory, and customer data for each store in real time from one place

- Add or update products and pricing across all stores or individually without disrupting operations

- Assign roles and permissions so branch managers access only their store’s data, while owners see everything

VTI’s POS Solution offers customizable software that scales with your business as well as commits to system maintenance and troubleshooting support during usage.

Comprehensive Security Framework

Businesses should also pay attention to data security and management from the very beginning of using POS to minimize customers’ data-related problems.

Data Protection Protocols:

- End-to-end encryption for all payment processing

- PCI DSS compliance implementation

- Regular security audits and vulnerability assessments

- Staff training on security best practices

Data Management Strategy:

- Automated backup systems with multiple recovery points

- Data retention policies aligned with regulatory requirements

- Analytics-ready data formatting for business intelligence tools

- Privacy compliance (GDPR, local data protection laws)

Business Continuity Planning:

- Offline operation capabilities during connectivity issues

- Disaster recovery procedures with defined RPO/RTO targets

- Regular system maintenance schedules with minimal business disruption

Ensuring Seamless Transactions with POS: How Staff Should Be Trained?

“Train your people well enough so they can leave, treat them well enough so they don’t want to.” This wisdom applies perfectly to POS payment training.

Training Timeline for New Hires

Day 1: Master the basics—logging in, processing simple sales, handling cash and card payments. Focus on building confidence with core functions.

Week 1: Advanced functions like processing returns, applying discounts, and generating basic reports. By week’s end, they should handle most customer scenarios independently.

Role-Based Access Strategy

Cashiers need access to sales processing, payment handling, and basic customer lookup functions.

Managers require additional permissions for point of sale report generation, inventory adjustments, user management, and pos billing corrections.

Administrative staff may need access to invoice management features and integration with your accounting pos software.

Avoiding Common Mistakes

Watch for these frequent errors during training:

Duplicate scanning of items, especially during busy periods when staff feel rushed.

Incorrect return processing that doesn’t properly restore inventory or process refunds correctly.

Forgetting to close shifts properly affects daily reconciliation and billing management system accuracy.

Training Tips That Work

Use the simulation mode available in most point-of-sale programs for risk-free practice with realistic scenarios.

Create visual guides and quick-reference cards for common procedures, especially helpful for multilingual teams common in Asia-Pacific businesses.

Regular refresher sessions keep skills sharp and introduce new features as your pos inventory system evolves.

Troubleshooting Guide: How to Solve Common POS Payment Issues?

Even the best systems occasionally hiccup. Here’s how to handle the most common problems quickly and professionally.

Transaction Failures

When pos payment processing fails, stay calm and follow this sequence:

Check card reader connectivity first—loose cables cause 60% of payment failures.

Verify internet connection for cloud-based systems. Many modern POS systems have offline modes that sync when connectivity returns.

Try alternative payment methods while investigating. Having backup options keeps customers happy during technical difficulties.

Hardware Troubles

Printer issues: Check paper loading, clean print heads monthly, and keep spare thermal paper rolls readily available.

Scanner problems: Clean the lens weekly with an appropriate cleaning solution, and verify USB or Bluetooth connections are secure.

Touchscreen responsiveness: Regular cleaning with appropriate screen cleaners maintains sensitivity and prevents false touches.

Slow System Performance

Regular restarts clear temporary files and refresh system memory—schedule these during off-peak hours.

Software updates often include performance improvements and bug fixes for your pos erp system.

Cache clearing in your invoice automation software prevents accumulated data from slowing operations.

When to Call for Help

Establish clear escalation procedures with your automated invoicing software vendor. Document error messages and circumstances to speed resolution when contacting support.

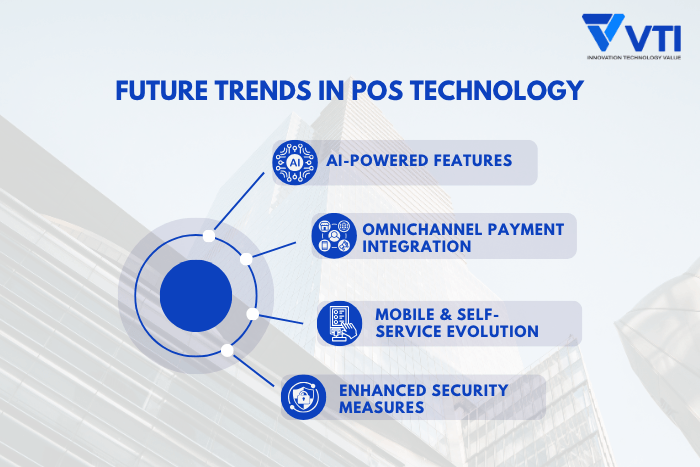

What are the Future Trends in POS Technology?

The POS payment industry evolves rapidly, especially in technology-forward markets across Asia-Pacific. Understanding emerging trends helps you make informed upgrade decisions.

AI-Powered Features

Predictive restocking analyzes sales patterns to forecast inventory needs, preventing stockouts during peak demand periods.

Smart customer recommendations personalize upselling opportunities based on purchase history and behavioral patterns tracked through your invoice processing automation system.

Leading retailers in Japan already use AI-enhanced POS systems to increase average transaction values by 15-20%.

Omnichannel Payment Integration

Unified payment experiences across online, mobile, and in-store channels eliminate friction for customers who shop multiple ways.

Your point of sale sales data integrates seamlessly with eCommerce platforms, providing complete customer journey visibility.

Mobile & Self-Service Evolution

Handheld POS devices empower restaurant staff to take orders tableside, improving service speed and accuracy.

Self-service kiosks in fast-food restaurants and retail environments reduce wait times while freeing staff for more complex customer service tasks.

Enhanced Security Measures

EMV chip card readers significantly reduce fraud risk compared to traditional magnetic stripe processing.

End-to-end encryption protects sensitive transaction data throughout the payment process.

Biometric access controls provide additional security layers for staff access to sensitive functions in your point of sale programs.

Conclusion & Actionable Next Steps

Mastering your POS system isn’t about memorizing every feature—it’s about understanding how to leverage technology to serve customers better and operate more efficiently.

Your Success Roadmap

Understand your system by exploring both hardware capabilities and software features systematically.

Invest in thorough training for all staff members, with role-specific access and regular skill updates.

Optimize continuously by reviewing settings, workflows, and performance metrics monthly.

Ongoing Improvement Strategy

Monthly system audits help identify bottlenecks and optimization opportunities in your pos billing processes.

Regular team meetings gather frontline feedback about system performance and customer interactions.

Stay informed about software updates and new features that could benefit your specific business needs.

Ready to Transform Your Business?

Implementing these strategies transforms struggling operations into smooth, efficient businesses that customers love visiting.

Whether you’re running a family restaurant in Bangkok, managing a retail chain in Manila, or operating a hotel in Kuala Lumpur, mastering your POS system pays dividends in customer satisfaction, operational efficiency, and bottom-line results.

Your POS terminal is ready to be your most reliable employee—now you know how to put it to work effectively.

Frequently Asked Questions (FAQs)

Q: How long does it take to train staff on a new POS Payment system?

A: For basic operations, most staff can become comfortable within 2-3 days of regular use. However, comprehensive training, including advanced features like invoice management and point of sale report generation, typically takes 1-2 weeks. The key is starting with essential functions and gradually introducing more complex features as confidence builds.

Q: What should I do if my POS Payment system goes down during peak business hours?

A: First, don’t panic. Most modern all in one pos system solutions have offline modes that continue processing transactions and sync when connectivity returns. Keep a manual backup system ready—simple receipt books and a calculator can maintain operations temporarily. Contact your vendor support immediately, and inform customers about temporary delays rather than turning them away.

Q: Can I integrate my existing accounting software with a new POS Payment system?

A: Most modern accounting pos software solutions offer integration capabilities with popular accounting platforms. Systems like Odoo, QuickBooks, and SAP commonly integrate with pos inventory system solutions. However, compatibility varies, so verify integration capabilities before making your final selection.

Q: What happens to my data if I switch POS providers?

A: Data portability varies by provider. Most reputable point of sale programs allow data export in standard formats, but some proprietary systems may limit this capability. Always clarify data export policies before signing contracts, and consider providers who offer migration assistance.

Q: How can I tell if my POS Payment system is processing transactions too slowly?

A: Monitor your average transaction time during peak hours. If customers wait more than 2-3 minutes for simple purchases, or if queues regularly exceed 5-6 people, your system may need optimization. Check your pos inventory system performance, internet speed, and hardware specifications. Sometimes, simple adjustments like clearingthe cache or updating the software can significantly improve speed.

Q: What should I look for in a POS Payment system for a multi-location business?

A: For multi-location operations, prioritize all in one pos systems with centralized reporting, real-time inventory synchronization across locations, and unified customer databases. Look for billing management system features that allow corporate oversight while maintaining location-specific flexibility. Cloud-based solutions typically handle multi-location needs better than on-premise systems.

Businesses seeking customized POS solutions with advanced AI integration and seamless device connectivity? That’s exactly what VTI specializes in. Contact us to discuss your requirements!

![[FREE EBOOK] Strategic IT Outsourcing: Optimizing Cost & Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)