Should your organization invest millions in building a global capability center, or stick with proven offshore partnerships that deliver immediate results? This critical decision affects your IT strategy, budget, and competitive advantage for years to come. While GCCs promise greater control and long-term value, traditional offshore models excel in flexibility and cost efficiency.

This comprehensive analysis examines when each approach works best, helping CIOs and IT managers make informed sourcing decisions that align with their strategic objectives and operational realities.

What is a Global Capability Center?

A global capability center (GCC) represents a fundamental shift in how multinational enterprises approach talent optimization and operational excellence. Unlike traditional offshore centers focused solely on cost reduction, a GCC functions as a wholly-owned strategic entity designed to consolidate and enhance specific organizational capabilities, including innovation, technology development, analytics, and digital transformation initiatives.

Think of a GCC as your company’s specialized brain trust located in a strategic global location. Rather than simply moving routine tasks overseas, you’re establishing a dedicated hub where your best talent can focus on high-value activities that directly accelerate business growth and competitive advantage.

Capabilities can significantly enhance competitive positioning in rapidly evolving markets.

Core Functions and Strategic Importance

The functions performed by modern GCCs are diverse and increasingly sophisticated. They often include:

- Information Technology: Application development and maintenance, cybersecurity, cloud management, and infrastructure support.

- Engineering and R&D: Product design, development, and testing for global markets.

- Data Analytics and Insights: Harnessing big data to inform business strategy and decision-making.

- Business Process Management: Handling complex, end-to-end processes in areas like supply chain, human resources, and finance.

- Innovation Hubs: Fostering new ideas, developing proofs-of-concept, and driving digital transformation initiatives.

The strategic importance of GCCs lies in their ability to provide greater control, foster a dedicated talent pool, and protect intellectual property, all while achieving operational efficiencies.

Differences Between GCC & Outsourcing Models

Outsourcing is a business practice where a company hires an external third-party provider to perform tasks, functions, or services that were previously handled by its own employees. Companies often use outsourcing to reduce costs, access specialized skills and expertise, and allow their in-house staff to focus on core business activities that drive growth.

>> Read more: Top 3 Common Types Of IT Outsourcing Models & How To Choose The Suitable One

For a clearer understanding of the differences between these two models, here’s a comparison table.

Comparison Table: GCC vs. Outsourcing

| Dimension | Global Capability Center (GCC) | Outsourcing |

| Ownership & Control | Fully owned and operated by the parent company | Managed by a third-party vendor |

| Strategic Role | Extension of enterprise, aligned with long-term goals | Tactical focus, mainly cost savings |

| Talent & Expertise | Builds in-house domain expertise, nurtures company culture | Vendor-controlled talent, higher turnover |

| Data Security & IP | Strong control over sensitive data and IP | Data/IP risk is higher, dependent on vendor policies |

| Cost Structure | Higher upfront investment, long-term ROI through innovation and efficiency | Lower initial cost, ongoing vendor fees, and hidden costs are possible |

| Flexibility & Innovation | High flexibility, can pivot with corporate priorities, focus on R&D, and transformation | Bound by vendor contracts, innovation depends on the provider |

| Cultural Alignment | Direct integration with corporate culture | Cultural and operational alignment challenges |

| Scalability | Scales in line with corporate vision and strategy | Scales based on vendor capacity and agreements |

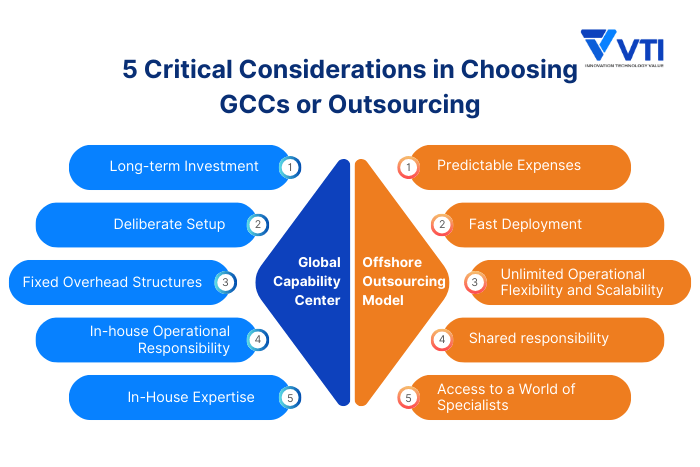

5 Critical Considerations in Choosing GCCs or Outsourcing

The rise of the Global Capability Center (GCC) has been nothing short of meteoric. With thousands of these centers now operating globally, many commentators have been quick to declare the end of the outsourcing era. The narrative is compelling: why rent when you can own? Why outsource when you can build a strategic, in-house extension of your own company?

But this view misses a crucial point. While GCCs are a powerful tool for innovation and long-term growth, they are not a silver bullet. Outsourcing, the practice of outsourcing specific functions to a third-party vendor, remains an indispensable strategy for businesses of all sizes.

The truth is, these two models aren’t competitors; they are complementary tools in a sophisticated global strategy. A Global Capability Center is a company-owned and operated entity in an offshore location – an “in-house” hub for high-value, strategic work. Outsourcing, on the other hand, involves contracting an external expert for non-core tasks.

Thinking that a GCC can do it all is a strategic misstep. Here are the five key reasons why your GCC can’t – and shouldn’t – replace outsourcing.

Long-term Investment vs. Immediate ROI

The financial paths of these two models diverge dramatically. One requires a significant, long-term investment, while the other offers immediate, predictable costs.

- Establishing a GCC global capability center demands significant upfront capital investment (CAPEX) in real estate, legal setup, IT infrastructure, and extensive hiring and training. This is a long-term strategic play, and the return on investment will not be immediate. The parent company assumes all the financial risks associated with building and running the center from the ground up. Many organizations cannot justify for short-term or project-based needs.

- Outsourcing, on the other hand, offers immediate cost benefits. It involves little to no initial setup cost, as the vendor already has the people and infrastructure in place. This provides a predictable operational expense (OPEX) model, with costs clearly defined in a service-level agreement (SLA), making budgeting far simpler. This makes it a much more accessible option for startups, mid-sized businesses, or even large enterprises looking to manage costs or test a new market.

Deliberate Setup Vs. Fast Deployment

In a market where speed is a competitive advantage, the time-to-market for each model is a critical factor.

- Building a GCC is a slow, deliberate process. The setup is inherently complex, involving legal incorporation, site selection, talent acquisition, and cultural integration. This can easily take many months, if not years, to become fully operational. Scaling a GCC is also a gradual process, as hiring and training must be done carefully to maintain quality.

- Outsourcing is built for speed. You can tap into a third-party vendor’s existing talent pool and have a project up and running in a matter of weeks. This model offers unparalleled flexibility to scale teams up or down quickly in response to fluctuating project demands or seasonal business cycles. It’s the ideal solution for projects with tight deadlines or for businesses that need to get to market fast.

Fixed Overhead Structures vs. Flexible and Scalable Operations

GCCs operate with fixed overhead structures that can make them less agile than their outsourcing counterparts, especially when it comes to scalability.

- Scaling a GCC is a major undertaking. When demand fluctuates or seasonal peaks occur, GCCs require months of planning and hiring to scale up. Scaling down can be even more challenging. This relative inflexibility particularly impacts organizations with variable workloads or unpredictable market conditions.

- Outsourcing vendors are built for agility. When demand fluctuates or seasonal peaks occur, offshore partners offer the agility to scale resources up or down within weeks, while GCCs require months of planning and hiring processes. This inflexibility particularly impacts organizations with variable workloads or unpredictable market conditions.

In-house operational responsibility vs. Shared responsibility

The two models present vastly different risk profiles, from day-to-day operational hurdles to complex regulatory compliance.

- With a GCC, the buck stops with you. The parent company bears 100% of the operational risks. This includes unforeseen costs, compliance issues, high attrition, and potential reputation damage from poor performance. A company can face issues like power outages, internet problems, or high employee turnover, all of which fall to them to resolve. Full accountability for compliance with all local and international regulations rests squarely on your shoulders.

- Outsourcing allows you to transfer risk. A significant portion of the operational burden is transferred to the third-party vendor, who is responsible for hiring, managing, and retaining talent. As local experts, they are also responsible for navigating the complexities of local regulations, significantly reducing the legal and compliance burden on your company.

In-House Expertise vs. Access to a World of Specialists

While a GCC cultivates deep internal knowledge, it can’t replicate the sheer breadth of expertise available in the global outsourcing market.

- GCCs build a deep well of knowledge. They create a concentrated pool of in-house expertise perfectly tailored to your company’s specific needs and technologies. However, this can sometimes lead to an insular environment, potentially closing you off from broader industry innovations. According to Zinnov, this geographic limitation can restrict access to specialized skills or cost-effective locations that traditional offshore arrangements readily provide.

- Outsourcing opens the door to a global marketplace. It provides immediate access to a diverse ecosystem of vendors, each with niche skills in specific domains – be it a particular software, a type of cybersecurity, or a specialized design skill. This allows you to select the “best-of-breed” vendor for each specific task, rather than trying to become an expert in everything. The competitive nature of this market constantly drives innovation and efficiency that you can leverage.

GCC vs Outsourcing: Which Model Fits Your Strategy?

Deciding between a Global Capability Center (GCC) and outsourcing isn’t a simple either-or choice; it depends on your organization’s strategic direction. The right path is shaped by factors such as operational scale, desired level of control, compliance requirements, and how central innovation is to your growth strategy.

A GCC is best suited for companies aiming to establish a long-term footprint in global talent markets, especially when intellectual property protection, data security, and control are critical. This model also enables organizations to build institutional expertise, retain specialized teams, and keep global and regional functions closely integrated. Businesses with ambitious transformation agendas and long-term digital priorities often leverage GCCs as in-house engines for innovation and change.

Outsourcing, on the other hand, is more appropriate for standardized, transactional services where speed, cost-effectiveness, and flexibility matter most. It works well when execution takes precedence over ownership, or when internal teams are better focused on higher-value initiatives. Common examples include IT helpdesks, customer support, and finance processing – areas that can be effectively managed under service-level agreements (SLAs).

Final words

The debate over GCCs versus outsourcing presents a false choice. These models are not mutually exclusive competitors. They are distinct, complementary strategies that, when used together, create a powerful and resilient global business model.

The right choice depends entirely on your strategic goals, financial situation, and the nature of the business function in question. The most successful global companies of the future will be those that master the art of blending these models – using a GCC for their strategic core and leveraging the best of the global offshoring market for everything else. This hybrid approach is the true key to creating a flexible, efficient, and powerful global operational footprint.

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)