Japan’s financial sector is nearing a major turning point, and COBOL bank systems are now at the center of that urgency. According to METI’s 2025 report, aging legacy financial systems, many built on COBOL, may increasingly limit banks’ ability to innovate and respond to new digital demands. These systems have delivered stability for decades, but growing technical debt, higher maintenance risks, and a shrinking pool of COBOL engineers are making modernization unavoidable.

As banks work to meet rising customer expectations and evolving regulatory requirements, the need to rethink core infrastructures has never been clearer. This is why many institutions are now exploring the modernization and migration of COBOL to prepare for the next era of digital banking.

In this article, we break down the role COBOL has played in Japan’s banking infrastructure, the challenges financial institutions face today, and what modernization means for the future of banking. Let’s dive in.

The role of COBOL in Japan’s banking systems

COBOL as the foundation of core banking operations

Even today, COBOL remains a core foundation of Japan’s banking systems rather than a niche legacy technology. Many core banking platforms, particularly those responsible for financial accounting, were originally built on COBOL and mainframe environments, and a significant portion of this code is still running in production. These systems support deposits, loans, settlements, and large-scale batch processing, embedding decades of business rules and regulatory logic that are deeply intertwined with daily banking operations.

In Japan, a bank’s core system is typically structured around three major components

– The accounting system

– The information system

– The channel system

This architectural distinction is critical to understanding where COBOL is actually used today. COBOL is most deeply embedded in the accounting system, which handles high-volume, high-precision transaction processing under strict consistency and reliability requirements. In contrast, information systems and channel systems such as online banking portals, mobile applications, CRM, and external integrations have largely transitioned to open architectures and modern programming languages.

This separation explains why COBOL continues to play a central role even as banks expand their digital services. While customer-facing layers have evolved rapidly, the accounting system remains highly conservative by design. Stability, determinism, and long-term operability are prioritized over flexibility, making COBOL and mainframe-style processing well-suited to this domain.

Modernized channels, but legacy cores remain

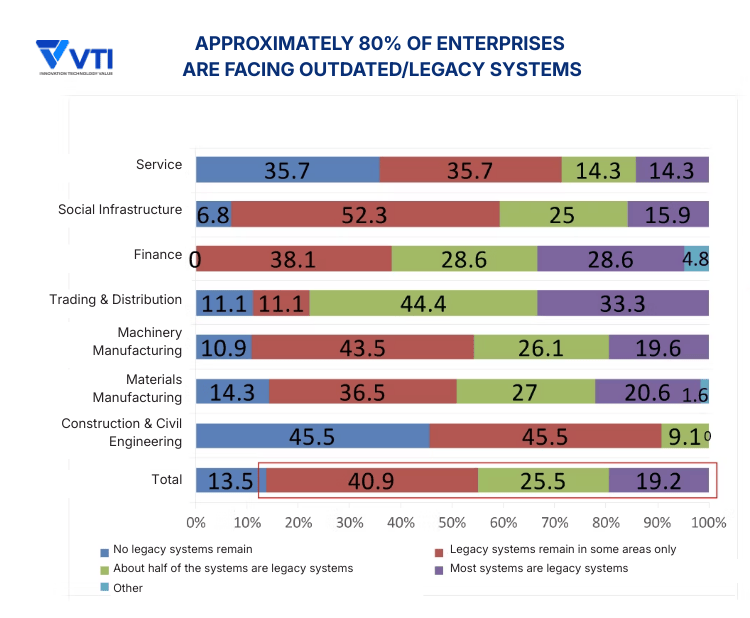

Industry surveys further reinforce this reality. According to the JUAS, approximately 80% of Japanese companies still operate legacy systems, with the financial sector consistently ranking among the most legacy-dependent industries.

When examining core systems (the category most closely aligned with COBOL-based financial platforms), the same survey shows that:

– 31.0% of companies had no modernization plan for core systems

– Only 5.7% had fully modernized their core systems

– The remaining shares were only partially modernized, underscoring how deeply traditional architectures persist in banking IT.

It is also worth noting that COBOL’s presence in banking systems is not simply a relic of the distant past. Historically, many online accounting systems relied on assembler or PL/I to meet stringent performance requirements. COBOL became more prevalent as financial transaction middleware and mainframe environments evolved to support it, offering a balance between performance, maintainability, and long-term system continuity. As a result, COBOL in Japan’s banking sector represents not outdated technology, but accumulated operational knowledge refined over decades.

Taken together, these factors explain why COBOL remains deeply embedded in Japan’s banking infrastructure. The technology continues to underpin the most critical layers of financial systems, where reliability and scale are non-negotiable, even as banks pursue modernization in surrounding systems.

Key Challenges Facing COBOL Bank Systems in Japan

Despite their proven reliability, COBOL-based banking systems in Japan face growing structural challenges. These challenges are well documented across industry surveys and are particularly acute in the financial sector, where system stability must be maintained even as digital demands accelerate.

Aging architectures create operational and scalability limits

Most COBOL systems were designed in an era when banking workloads were batch-driven. This architecture is now a major constraint:

– Over 46.6% of companies report “system complexity” as the top barrier to modernization (JUAS IT Trend).

– Many core banking batches still run hundreds of chained COBOL jobs, making even small changes risky.

This means introducing real-time APIs, open banking integrations, or cloud-native services often requires major structural rework—not just coding updates.

Extreme scale makes core banking systems hard to replace

A defining challenge for banks, especially megabanks, is system scale. Large regional banks manage several million accounts, while Japan’s megabanks operate at 10 to 50 million accounts. At peak times, transaction volumes reach several thousand to nearly 10,000 transactions per second, requiring strict consistency and real-time state management.

Such workloads depend on stateful, in-memory processing, where mainframe architectures and COBOL-based systems retain clear strengths. As a result, core accounting systems remain difficult to move away from mainframes, even as surrounding systems adopt open technologies.

RDBMS-based core banking platforms such as Oracle FlexCube or Temenos T24 suit online banks and smaller institutions, but scaling them to megabank volumes requires significant customization and cost. This is reflected in the architectures of Japan’s major banks: MUFG uses a hub-and-spoke model with IBM MQ, SAIL, and IMS on mainframes; SMBC operates a horizontally distributed, batchless accounting system; and Mizuho Bank rebuilt its core after 2011 using a full SOA model, retaining mainframes only for liquid deposit processing.

These examples show that COBOL-based cores persist not out of inertia, but because they are embedded in large-scale, institution-specific system designs.

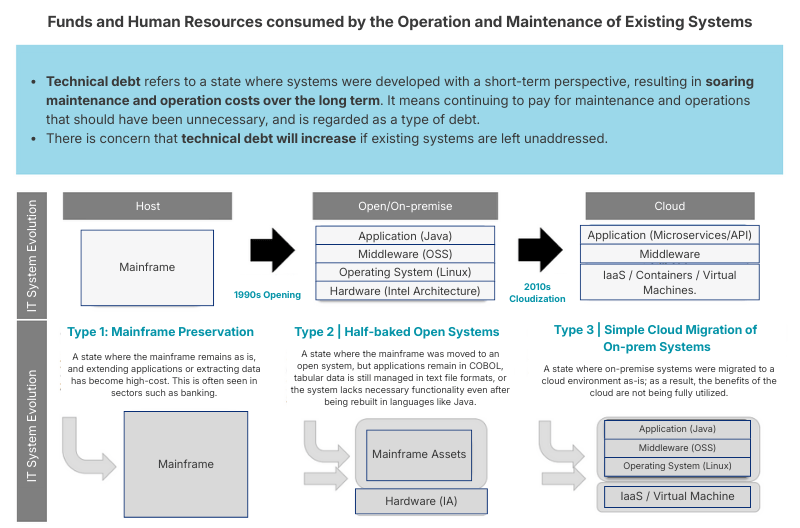

Technical debt continues to grow with measurable impact

METI’s DX report warns that if legacy technical debt is ignored, Japan could face up to ¥12 trillion in annual economic losses starting in 2026.

In banking IT, this debt manifests as:

– COBOL programs that have been modified thousands of times across decades

– Business rules are embedded directly in code rather than documentation

– Code paths no longer understood by active engineers

According to JUAS, 33.2% of organizations cite “loss of system knowledge” as a modernization barrier, clear evidence of the growing black-box effect in COBOL systems.

Severe and accelerating shortage of COBOL engineers

The talent shortage is not anecdotal. It is quantifiable. According to IPA:

– Over 60% of COBOL engineers in Japan are over age 50.

– Fewer than 5% of new engineers have experience with COBOL.

– By 2030, Japan is projected to face a shortage of up to 790,000 IT engineers, heavily concentrated in legacy skillsets.

For banks, this shortage translates directly into longer turnaround times, rising labor costs, and increased operational dependency on a shrinking group of specialists, further elevating system risk.

High maintenance costs prevent innovation

Multiple studies, including METI and private-sector research, show that:

– Many companies spend 70–90% of their IT budgets maintaining legacy systems.

– Only 10–30% remains for new development or transformation initiatives.

In financial institutions with large COBOL estates, this imbalance is often even more pronounced due to the mission-critical nature of core banking operations. As a result, banks can modernize customer-facing channels while remaining unable to transform the COBOL core that powers them.

A “two-speed architecture” is forming and choking innovation

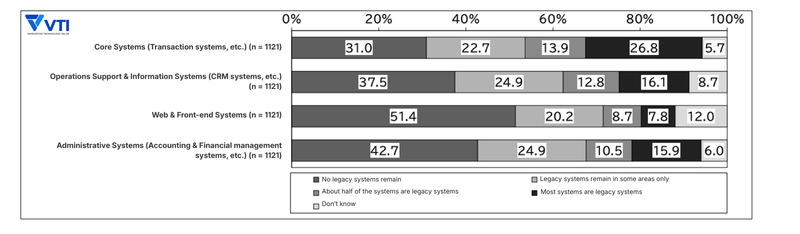

Modern customer-facing channels (web, mobile, CRM) are evolving quickly, but core COBOL bank systems are not. JUAS modernization status data shows:

– Only 5.7% of core systems are fully modernized

– Over 31% have no modernization plan at all

– Meanwhile, 20%+ of web systems are already fully modernized

This “two-speed architecture” creates architectural friction fast-moving digital layers constrained by slow-evolving COBOL cores, leading to higher integration costs, longer delivery cycles, and increasing system fragmentation.

Together, these challenges explain why COBOL bank systems remain difficult to replace, and why modernization in the financial sector is not simply a technical upgrade, but a complex, high-stakes transformation.

Why modernization has become critical for financial institutions

The challenges surrounding COBOL-based core systems are now affecting Japan’s financial sector at a strategic level. As digital expectations rise and competitive pressures increase, modernizing financial legacy systems has become a critical priority for banks aiming to remain relevant.

Digital banking requires capabilities that COBOL cores cannot support natively

Customer behavior has shifted dramatically in the past five years.

Real-time transfers, mobile onboarding, instant loan approval, API-based services—these are now standard expectations.

However, COBOL bank systems were designed for predictable batch cycles, not continuous digital interaction. As a result:

Time-to-market for new digital products slows dramatically

– API integration is constrained

– Cross-platform consistency becomes harder to maintain

– Modernization is now essential simply to meet baseline digital expectations.

Regulatory and compliance requirements continue to evolve

Financial regulators in Japan are increasing expectations for:

– Continuous risk monitoring

– Traceable data flows

– Standardized audit trails

– Rapid reporting capabilities

Legacy COBOL cores, where business logic is deeply embedded in code, struggle to provide the transparency and agility required for modern compliance.

Modern architectures (APIs, microservices, containerization) not only reduce risk but also enable faster compliance alignment.

Japan’s competitive landscape is changing

Fintech companies, digital-first banks, and foreign players are delivering:

– Lower-cost operations

– Real-time experiences

– Personalized, data-driven financial products

This competitive pressure is new and growing fast. Banks relying on monolithic COBOL cores cannot match the speed of cloud-native players. Modernization has shifted from optional improvement to strategic defense.

Legacy systems were not built for ecosystem banking

The future of financial services in Japan includes:

– API-based open banking

– Embedded finance

– Partnerships with non-bank platforms (e-commerce, mobility, retail)

cross-industry data integration

COBOL bank systems cannot natively support ecosystem-level connectivity. Banks that modernize early can participate in new revenue models. Banks that wait risk structural exclusion.

Modernization unlocks operational and business agility

This is the part most CIOs emphasize in transformation planning:

– Modular architectures allow faster product iteration

– Cloud-native infrastructures reduce operating costs

– Data becomes easier to analyze and operationalize

– Risk management improves through better visibility

In other words, modernization enables banks to operate differently, not just “upgrade the system.”

Modernization approaches for COBOL bank systems

Modernizing COBOL-based core systems is not a “one-size-fits-all” initiative. Financial institutions must select an approach that balances risk, cost, speed, and long-term flexibility. In Japan, banks typically adopt one of the following pathways for COBOL modernization and COBOL migration, often combining multiple methods over several phases.

Here are the 6 most popular modernization methods:

Rehosting (Lift & Shift)

Rehosting moves COBOL workloads from mainframes to cloud or virtualized environments without touching the code. For many banks, it is the first step simply because it is the safest. It lowers infrastructure cost, stabilizes operations, and removes hardware risk all without changing business logic.

This approach is ideal when:

– The bank needs immediate cost reduction

– Modernization must begin with zero disruption

– The institution is preparing for bigger changes later

Rehosting does not modernize COBOL itself, but it creates breathing room for future planning.

Replatforming

Replatforming adjusts the surrounding technology (databases, schedulers, middleware) while keeping COBOL code mostly unchanged. For banks struggling with slow batch windows or aging middleware, this step offers tangible benefits without rewriting systems.

Banks choose replatforming when:

– Performance and reliability need improvement

– Modern infrastructure features (monitoring, automation) are required

– They want modernization without risking core stability

It is a middle-ground approach: more modern than rehosting, but still low-risk.

Refactoring

Many Japanese banks run COBOL systems that have been modified for decades. Over time, logic becomes tangled, documentation disappears, and a system turns into a “black box.” Refactoring helps untangle this complexity and restore clarity.

Refactoring is helpful when:

– The system is stable but difficult to maintain

– Knowledge loss is becoming a risk

– The bank wants to prepare for future API or cloud integration

It does not change the COBOL bank’s architecture, but it makes modernization possible.

Rearchitecting

Rearchitecting transforms monolithic COBOL bank systems into modular or microservices-based architectures. This is a significant step that changes how a bank builds, deploys, and operates technology. It allows teams to release updates faster, scale specific services independently, and adopt cloud-native practices.

Banks choose rearchitecting when:

– The business needs a real-time capability

– They want to reduce dependency on nightly batch processes

– Agility is central to future strategy

It is a major transformation, but also one that delivers a lasting competitive advantage.

Rebuilding

Rebuilding replaces COBOL bank systems entirely with modern languages and architectures. This is the most ambitious approach, often spanning years, but it provides a clean, future-proof foundation.

Rebuilding is appropriate when:

– Technical debt is overwhelming

– The system no longer fits regulatory or business needs

– Modernization cannot rely on incremental changes

It is a high-investment, high-return decision, typically aligned with long-term business transformation.

Replacement

Some banks choose to retire COBOL cores altogether and adopt packaged or SaaS-based core banking platforms. This approach reduces operational complexity and leverages proven industry-standard functionality.

Replacement makes sense when:

– The bank wants to simplify processes across branches or regions

– Customization has become too costly

– Adopting a common platform provides better economics

Replacement reduces legacy risk, but requires deep organizational alignment.

When to choose the modernization approach

To help banks evaluate their options more clearly, the table below summarizes how each modernization approach differs in scope, risk, speed, and ideal use cases.

| Approach | Change scope | Risk level | Speed | Idea when |

| Rehosting | Infrastructure only | Low | Fast | You need quick cost reduction + system stability |

| Replatforming | Platform/middleware | Low-medium | Medium | You want better performance & cloud compatibility |

| Refactoring | Code quality | Low | Medium | Technical debt is slowing maintenance or causing incidents |

| Rearchitecting | System architecture | Medium-high | Slow | You need agility, real-time capability, and cloud-native design |

| Rebuilding | Full code rewrite | High | Very slow | A legacy system cannot meet long-term business needs |

| Replacement | Core system change | High | Slow | Standardization is more valuable than customization |

Conclusion

In sum, COBOL has supported Japan’s banking systems for decades, delivering the stability and precision the industry relies on. Yet as digital services expand and legacy systems age, the limitations of COBOL-based cores are becoming increasingly clear. Banks now face a turning point: maintain reliability while preparing for faster, more connected, and more resilient digital operations.

In the coming years, COBOL will remain part of Japan’s financial infrastructure, but it can no longer serve as the primary engine for innovation. By adopting a strategic modernization roadmap, banks can reduce operational risk, improve agility, and prepare for the next generation of financial services in a digital-first economy.

If your organization is considering the modernization of COBOL bank systems, VTI would be honored to offer support grounded in our experience with large-scale financial transformations. By combining AI-assisted code analysis and rewriting, cost-efficient offshore capabilities in Vietnam, and Japan-based quality assurance led by experienced engineers, we strive to provide modernization services that are both reliable and scalable.

Should you have any questions or wish to discuss your future system strategy, please feel free to contact us at your convenience. We would be pleased to assist in any way we can.

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)