Not long ago, AUTOSAR was mostly the domain of embedded software teams. Today, it’s a strategic pillar for OEMs, Tier-1 suppliers, and software leaders navigating the shift to software-defined vehicles (SDVs). Designed to deliver both standardization and scalability, AUTOSAR now sits at the heart of modern automotive software architectures.

But adopting AUTOSAR is only the first step. Scaling it effectively means making the right architectural decisions, aligning platforms across product lines and regions, and avoiding common missteps that can slow delivery or increase technical debt. In this article, we explore how AUTOSAR is being implemented and outline what decision-makers should consider when shaping their next-generation automotive software strategy. Let’s dive in!

What Is AUTOSAR?

The definition

AUTOSAR, short for Automotive Open System Architecture, has been around since 2003. It was launched by a coalition of major automotive players (BMW, Bosch, Daimler, Continental, Siemens VDO, and Volkswagen) with one goal in mind: fix the chaos in how ECUs were being developed. The idea was simple but powerful: create the AUTOSAR standard that’s scalable, reusable, and ready for the complexity of modern vehicles.

A component-based architecture

Instead of building monolithic software stacks from scratch, AUTOSAR introduces a component-based approach. Software Components (SWCs) are developed with defined interfaces, making them reusable across different vehicle models, platforms, suppliers, and generations. This modularity helps:

– Speed up development cycles

– Improve maintainability

– Enable parallel development across global teams

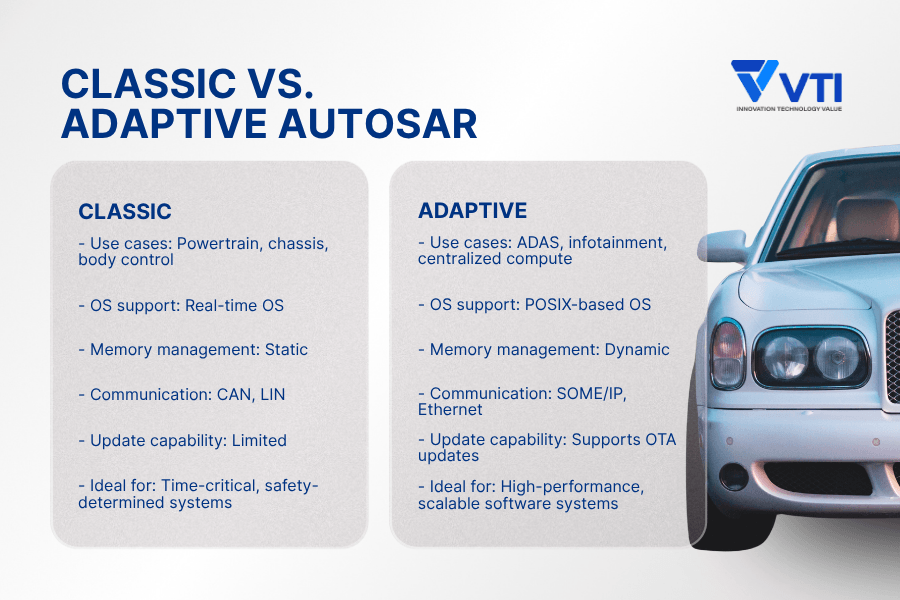

Classic vs. Adaptive platforms

There are two primary AUTOSAR platforms in use:

– Classic Platform (CP): Tailored for real-time functions running on resource-constrained ECUs like powertrain, chassis, and body control. Known for deterministic behavior, CP is robust, mature, and widely used in mass production.

– Adaptive Platform (AP): Built for compute-intensive domains such as ADAS, infotainment, and centralized vehicle computing. AP supports POSIX-based OSs, dynamic memory management, and service-oriented communication (e.g., SOME/IP), making it ideal for over-the-air updates and modern software-defined vehicles.

Why AUTOSAR Matters Now

Why SDVs need an AUTOSAR

A SVD isn’t simply a car with more software. It’s a completely different product. The real shift lies in how that software is developed, deployed, and evolved across functions, suppliers, and time. And that’s exactly where AUTOSAR matters.

Modern vehicles are pushing the edge of complexity, with upwards of 100 ECUs coordinating everything from braking and steering to infotainment and driver assistance. Without structure, that complexity becomes unsustainable. AUTOSAR brings a modular vehicle software architecture that’s modular, scalable, and most importantly, designed to last.

What that means in practice:

– Teams reuse AUTOSAR components across programs and suppliers instead of rebuilding code for every new platform or partner

– Instead of tightly coupling software to hardware, AUTOSAR acts as the automotive middleware layer, making it easier to scale across chipsets and upgrade over time.

– The architecture offers defined interfaces and diagnostics that support safety, performance, and maintainability, instead of reinventing how systems communicate.

The pressure to deliver safe, connected, and updatable vehicles isn’t letting up. And trying to scale that on top of fragmented, legacy codebases? It’s a non-starter. That’s why more OEMs are building their future platforms on the AUTOSAR standard. Not because it’s trendy, but because it solves problems that are already here.

AUTOSAR’s 2025 Momentum

The shift toward AUTOSAR is already happening fast. By 2025, over half of global OEMs are expected to have adopted some level of AUTOSAR-compliant architecture, and not just for R&D pilots. We’re seeing full-scale integration across infotainment, ADAS, powertrain, and increasingly, zonal architectures.

Two compelling indicators underline its strategic significance:

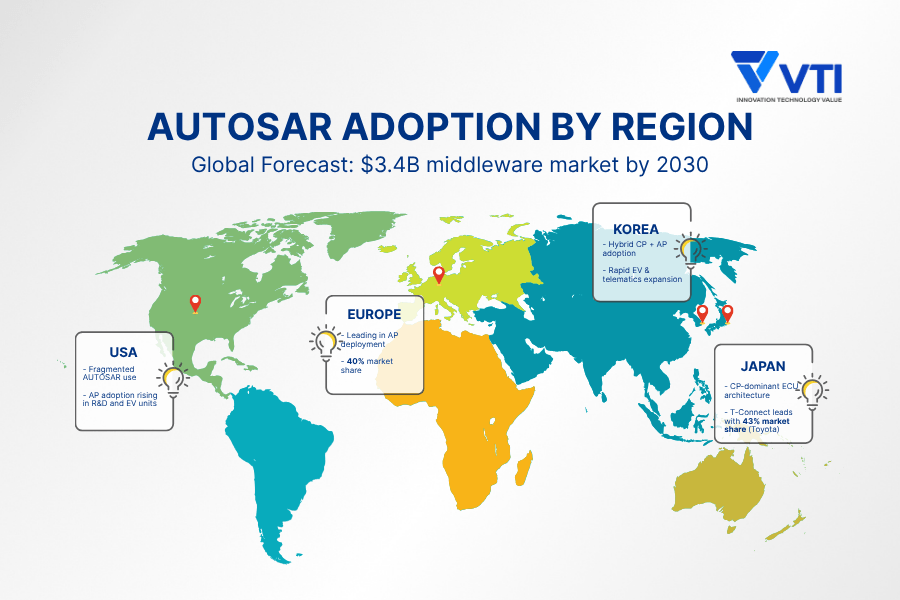

– Forecasts place the AUTOSAR middleware market at USD 1.63 billion in 2023, growing at approximately 11.1% CAGR to reach USD 3.4 billion by 2030.

– In the same period, AP is projected to expand faster than the Classic Platform, capturing a growing share of middleware revenue as OEMs prioritize centralized computing, safety partitioning, and OTA capability.

This growth is regionally uniform:

– Europe leads with over 40% market share, driven by regulatory alignment and platform standardization.

– Asia-Pacific, particularly Japan and Korea, is the fastest-growing region, thanks to production-scale rollout in EVs, ADAS, and zonal architectures.

Tier-1 suppliers, meanwhile, are reshaping their own tooling and product strategies to align with AUTOSAR. Toolchain compatibility, integration support, and middleware versioning are now boardroom topics, not just engineering concerns.

How OEMs Are Operationalizing AUTOSAR

Modern passenger EVs: CP still reigns, but AP is moving up the stack

Classic Platform remains dominant in domains such as powertrain and body control, where deterministic timing and hardware linkage matter. Well-established AUTOSAR toolchains and validated RTE generation make it reliable for mass-production flows.

Meanwhile, Adaptive Platform pilots are now project-critical: zonal compute adaptions, infotainment clusters, OTA orchestration, ADAS modules. Companies like Volkswagen and Stellantis are implementing AP in zonal ECU clusters using service-oriented AUTOSAR architecture. Automated configuration tools such as AUTOSAR Builder help manage XML descriptions, RTE generation, and BSW layering across supplier inputs, ensuring consistency and safety compliance.

The strategic workflow resembles what early PSA pilot projects demonstrated:

– Suppliers deliver SWC defined by standardized description files (.arxml)

– OEMs import legacy signal descriptions and vehicle matrix formats, transforming them into Virtual Functional Bus (VFB) compatible models

– Tools validate both XML metadata and generated C code via SCVT-like modules to ensure traceability and consistency before RTE contract code is finalized

Premium commercial fleets: hybrid AUTOSAR with operational discipline

Commercial deployments add complexity—diverse vehicle variants, U-based models, evolving V2X compliance, and fleet dashboards. OEMs like Volvo Trucks are managing this through hybrid architectures:

– CP remains responsible for time-critical control logic

– AP powers high-level diagnostics, over-the-air updates, and telematics-hosted analytics

Integration workflows replicate early use cases focused on supplier-ecosystem coordination. AUTOSAR toolchains enable:

– Multi-vendor SWC verification

– Topology and communication matrix import from existing ECU descriptions

– Scripted automation to configure BSW modules and COM stacks based on legacy data

These capabilities help fleets maintain uptime while scaling software configurations across vehicle variants without duplicating functional logic or manual steps.

Autonomous platforms: AP as foundation, integration as enabler

In autonomous development (L4+ vehicles, AV shuttles, robotaxis), Adaptive AUTOSAR is the runtime backbone. The architectural rationale:

– POSIX OS support, dynamic memory allocation, service-oriented communication (e.g., SOME/IP)

– Diagnostic and safety partitioning for autonomous compute stacks

– Reconfigurable middleware architecture to support AI/ML workloads and modular sensor fusion

Companies like Mobileye and NAVYA are implementing fully AP-first stacks, where sensor management, perception services, and OTA orchestrators reside in separate SWCs. These are validated through AUTOSAR authoring tools that manage VFB-to-RTE abstraction and ensure each component aligns to compliance and functional-safety invariants.

VTI’s case study: Seamless SAP S/4HANA Cloud Migration for a Top Japanese Automotive Manufacturer

How AUTOSAR Plays Out Globally

The pace and priorities of AUTOSAR adoption look very different depending on where you’re standing. AUTOSAR’s global footprint is a study in contrast and strategy.

Europe

Europe remains the global frontrunner in Adaptive AUTOSAR (AP) deployment, driven by regulatory mandates, centralized vehicle computing, and a mature Tier-1 ecosystem. Automakers like Volkswagen, Stellantis, and BMW are embedding AP into zonal and centralized architectures, enabling high-performance applications from ADAS to infotainment to software-over-the-air (SOTA).

European suppliers and OEMs account for an estimated 30–35% of global AUTOSAR middleware revenue in 2024, second only to Asia-Pacific. This leadership is powered by strict timelines tied to UNECE regulations, deep supplier collaboration, and broad AP deployments across production platforms, not just innovation labs.

Japan

Japan’s rollout of AUTOSAR, especially Adaptive, remains measured. Classic AUTOSAR still dominates ECU design across most mainstream models, especially in body, powertrain, and chassis control. That said, signs of software transformation are emerging.

According to Counterpoint Research, connected car sales in Japan surged 34% YoY in Q1 2025, with Toyota commanding a 43% share, powered by its T-Connect platform. This growth marks a clear shift toward software-centric innovation, even if AP deployments remain largely in pilot or high-end programs.

Korea

Korean OEMs like Hyundai and Kia are charting a pragmatic course: start with CP for control, layer in AP for infotainment, connectivity, and telematics. The result is a fast-evolving hybrid architecture strategy—lean enough to scale, but flexible enough to evolve.

AUTOSAR-based platforms are now surfacing across multiple high-growth Korean models, including electric SUVs and next-gen commercial fleets. Korea’s aggressive EV targets and software-defined ambitions make it a compelling testbed for mid-tier AP expansion.

U.S.

In the U.S., AUTOSAR adoption is fragmented. Established OEMs like GM and Ford largely retain CP for core production vehicles, while their EV divisions and advanced engineering teams explore AP for connected services, centralized computing, and OTA workflows.

At the same time, nontraditional players like Tesla and Rivian continue to bypass AUTOSAR in favor of custom stacks. Yet AP is gaining ground in Tier-1 R&D, startup ecosystems, and AI-driven safety systems, especially where ISO 26262 alignment and toolchain reuse matter.

AUTOSAR Pitfalls OEMs Can’t Afford in 2025

Strong architecture can still fail without disciplined execution. These are the mistakes that derail AUTOSAR strategies—most of them avoidable, all of them costly.

Misaligned platform choices

Classic AUTOSAR remains the right fit for safety-critical, real-time domains, but it struggles in areas requiring dynamic updates or scalable compute. Adaptive AUTOSAR (AP) enables those capabilities, but comes with performance overhead and hardware dependencies. Using the wrong platform for the wrong domain adds complexity, not clarity. Match platform to domain, nothing less.

Treating integration as a one-time project

Too many teams treat AUTOSAR like a single-phase rollout. It’s not. Software evolves. Versions shift. Suppliers change. Treating integration as a milestone instead of a continuous process leads to drift, rework, and delays. Make compliance part of your delivery cadence, not a checkbox.

Toolchain fragmentation

Without a unified toolchain, CP and AP implementations quickly diverge. Inconsistent XML handling, mismatched RTE layers, and incompatible configuration formats surface late in the game—right when timelines tighten. Standardizing toolchains across internal teams and supplier networks ensures smoother handoffs and traceability.

Weak SWC validation

Suppliers often deliver SWCs that don’t fully align with system requirements: interface mismatches, undefined runnables, or non-conforming implementations. Relying on “plug-and-play” assumptions is risky. Establish static validation processes early, both at the XML level and during C-code generation.

Losing track of middleware versions

CP and AP toolchains evolve quickly. If teams don’t track middleware versions, runtime behaviors shift unexpectedly and compliance gaps emerge. Version mismatches can surface during integration, not development, when they’re hardest to fix. Manage versioning deliberately across your supply chain.

Skipping safety and security traceability

AUTOSAR supports ISO 26262 and automotive cybersecurity standards, but that support isn’t automatic. Without rigorous traceability from requirement to runnable to test, certification becomes fragile. Build traceability into your process. Don’t bolt it on.

Conclusion

As AUTOSAR cements its place at the heart of modern automotive software, the execution gap is widening. Getting the architecture right is table stakes. Scaling it across models, suppliers, and regions, that’s the real challenge.

At VTI, we help OEMs and Tier-1s do just that.

From middleware integration to AP/CP platform harmonization, our automotive software development teams bring deep domain expertise and production-grade engineering to complex AUTOSAR programs. Whether you’re launching a new SDV initiative or modernizing legacy stacks, we build systems that perform, scale, and comply by design.

If you’re looking to move faster without cutting corners, let’s talk. We understand the stakes and we know how to deliver.

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)