The numbers tell a compelling story. In Asia-Pacific regions, contactless payments have surged by over 300% since 2020. Customers are increasingly expecting quick and hygienic payment options. Meanwhile, business owners discover they can cut costs dramatically while improving service quality. All in all, the most ultimate solution for those requirements is exactly mPOS (mobile POS).

This guide reveals how mPOS can transform your business operations, explores real use cases stories from across the Asia-Pacific region, and provides actionable steps to choose and implement the right mobile pos system for your needs.

What Is mPOS? Understanding Mobile POS Systems

What is mPOS?

Mobile Point of Sale (mPOS) is a portable payment solution that transforms smartphones, tablets, or dedicated wireless devices into complete payment terminals. Think of it as carrying a cash register in your pocket – but smarter, faster, and more powerful.

Unlike those bulky traditional cash registers that chain you to one spot, mPOS gives you the freedom to accept payments anywhere your business takes you.

Core Functionalities: Your Pocket-Sized Business Partner

Must Have Functions

Multi-Method Payment Processing: Essential payment processing capabilities include credit and debit card support, mobile wallet integration for popular platforms like Alipay, WeChat Pay, GrabPay, and LINE Pay, contactless NFC payments, and QR code payment options.

Basic Inventory Management: This essential POS function automatically updates inventory counts after each sale, eliminating manual counting errors and ensuring you always know what’s available. This real-time visibility prevents the frustrating scenario of losing sales because you thought you had inventory when you actually didn’t.

Basic Reporting and Analytics: Essential reports include daily sales summaries, transaction histories, top-performing product analysis, and peak business hour identification. This reporting functionality helps business owners understand their operations better and make data-driven decisions for growth.

Transaction Security: Your POS system must scramble customer payment data so hackers cannot read it, even if they somehow access your system. Remember, one security breach can destroy years of building customer trust and potentially result in significant financial penalties.

Mobility and User-Friendly Interface: Your POS software should run smoothly on smartphones and tablets, feature simple and clear buttons and menus, and require minimal training for new employees. User-friendly interfaces also reduce training time and minimize user errors during busy periods.

Basic Hardware Integration: Basic hardware integration eliminates the frustration of dealing with incompatible equipment and ensures your POS system works reliably from day one. Without proper hardware integration, even the best POS software becomes useless.

Nice to Have Functions

Digital Receipts via Email or SMS: Digital receipt functionality allows businesses to send receipts via email or SMS instead of paper, serving dual purposes of reducing environmental impact and collecting valuable customer contact information for future marketing campaigns. This feature appeals to environmentally conscious customers while building your marketing database organically through normal business transactions.

Customer Loyalty Programs: Built-in customer loyalty programs enable automatic point accumulation and discount application directly at checkout, eliminating the need for separate cards or apps. These automated loyalty systems encourage repeat business while providing valuable customer behavior data for targeted marketing efforts.

Personalized Shopping Assistance: Advanced POS systems offer personalized shopping assistance through product recommendations based on customer purchase history and preferences. This feature acts like a digital sales assistant, suggesting complementary products during checkout.

Self-Service Checkout: Self-service checkout functionality enables customers to scan and pay for items independently, reducing wait times during peak periods and potentially lowering labor costs. This feature is particularly popular in larger retail environments where customers appreciate the convenience of faster checkout options. Self-service capabilities can significantly improve customer experience while optimizing operational efficiency.

Advanced Customer Relationship Management (CRM): This feature includes comprehensive customer profiles with purchase history, contact information, demographic data, and behavioral analytics. Advanced CRM capabilities enable businesses to develop highly targeted marketing strategies and build stronger customer relationships through personalized communications and offers.

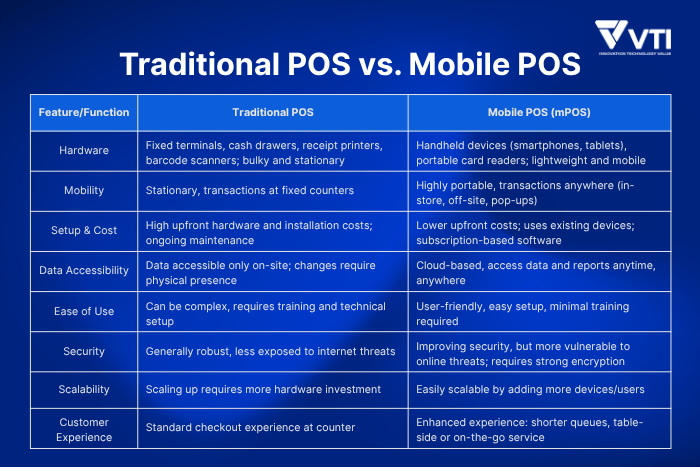

Comparing Traditional POS vs. Mobile POS

Imagine comparing a desktop computer to a smartphone. That’s essentially the difference between traditional and mobile point of sale systems.

Related: Comparison between Cloud POS and Traditional POS

Benefits of mPOS for Businesses

Cost Efficiency: More Profits, Less Investment

Traditional POS systems often require investments of $3,000-$10,000 upfront. Modern mobile pos terminals flip this equation entirely.

Hardware Costs Slashed: Many mPOS providers offer free card readers when you sign up. Even premium hardware rarely exceeds $300.

Subscription Flexibility: Instead of massive upfront payments, you pay predictable monthly fees, often starting under $30 per month.

Sarah, who owns a boutique in Singapore, calculated her savings: “My old POS system cost $5,000 plus $200 monthly maintenance. My new pos mobile solution costs $39 monthly total. I’m saving over $4,000 annually.”

Flexibility & Mobility: Business Freedom Redefined

The “mobile” in the mobile pos system isn’t just marketing speak – it’s transformational freedom.

Anywhere Operations: Process payments at trade shows, customer locations, or pop-up events without missing a beat.

Line-Busting Capabilities: During busy periods, staff can process payments anywhere in your store, eliminating checkout bottlenecks.

Event-Ready: Weekend markets, seasonal festivals, or temporary locations become profitable opportunities rather than logistical nightmares.

Enhanced Customer Experience: Happy Customers, Better Reviews

Customer experience improvements directly impact your bottom line through repeat business and positive reviews.

Reduced Wait Times: Customers appreciate faster checkouts and shorter lines.

Personalized Service: Access customer histories and preferences instantly, enabling personalized recommendations.

Professional Appearance: Modern payment processing signals that your business stays current with technology.

Secure Transactions: Bank-Level Protection

Security concerns often top the list when businesses consider online POS systems. Fortunately, POS security modern solutions – especially mobile POS (mPOS) – offer superior protection compared to many traditional systems.

Built-in Security Protocols: Tokenization replaces sensitive card data with unique identifiers, making stolen data useless to criminals.

PCI-DSS Compliance: Reputable providers meet the same security standards as major banks.

End-to-End Encryption: Payment data stays protected from the moment customers swipe until it reaches your bank.

Inventory & Sales Tracking: Data-Driven Decisions

Real-time data access transforms how you manage inventory and understand sales patterns.

Live Stock Updates: Know exactly what’s selling and what needs restocking without manual counts.

Sales Pattern Recognition: Identify your best-selling items, peak hours, and seasonal trends.

Automated Reordering: Some systems can automatically suggest or initiate reorders when stock runs low.

Business Tool Integration: Your Unified Command Center

Modern pos online platforms don’t operate in isolation – they connect your entire business ecosystem.

Accounting Integration: Sync automatically with QuickBooks, Xero, or other accounting software.

CRM Connection: Customer data flows seamlessly between your POS and customer relationship management tools.

E-commerce Synchronization: Online and offline inventory stay perfectly aligned.

mPOS Use Cases: How Businesses Are Leveraging Mobile POS

Retail Stores: Revolutionizing the Shopping Experience

In-Aisle Assistance: Staff equipped with mobile POS devices can complete sales anywhere in the store, turning product inquiries into immediate purchases.

For example, a boutique reduced average transaction time from 45 to 31 seconds (a 31% improvement), which allowed staff to serve more customers during peak hours and shortened checkout lines. This led to a 15% increase in monthly revenue and a 25% improvement in inventory accuracy, reducing stockouts and overselling.

Pop-Up Success: Temporary locations for seasonal sales or new market testing become profitable ventures rather than risky experiments. Seasonal sales, promotional events, and new market testing often require temporary retail locations.

The portability and cloud-based nature of mPOS allow retailers to deploy and dismantle operations rapidly, capturing sales opportunities wherever foot traffic is highest.

Inventory Harmony: Customers can buy items whether they’re shopping online or in-store, with inventory automatically synchronized across all channels. Customers increasingly expect a unified shopping experience across online and offline channels.

Mobile POS systems synchronize inventory in real time, ensuring that stock levels are accurate whether customers shop in-store, online, or via mobile apps. This omnichannel inventory management reduces stockouts and overselling, enhancing customer trust and loyalty.

For example, Hiroshi, who manages an electronics chain in Osaka, reported a 40% increase in conversion rates after implementing mobile POS terminals that allow checkout right in the aisle where customers shop. This approach transforms sales associates into mobile checkout points, creating a seamless shopping experience.

Food & Beverage Industry: Serving Success

Restaurants, cafes, and food vendors are among the most enthusiastic adopters of mPOS due to the operational efficiencies and improved customer experience they enable.

Tableside Payments: Restaurants use mobile POS to allow customers to pay immediately at their table, eliminating the need to wait for the server to bring the bill and return with change or card slips. Mai, owner of a popular pho restaurant in Ho Chi Minh City, shared that tableside payments reduced average table turnover time by 15 minutes during lunch rushes, enabling her to serve 30% more customers. This faster service boosts revenue and customer satisfaction.

Food Truck Efficiency: Mobile food vendors leverage mPOS to process orders and payments simultaneously, dramatically reducing service time and increasing throughput. The compact and wireless nature of mPOS devices fits perfectly with the mobile and space-constrained environment of food trucks.

Cafe Optimization: Coffee shops use mPOS solutions to take orders and payments before customers reach the counter, reducing perceived wait times and smoothing customer flow during peak hours. This pre-order capability enhances customer experience and increases sales volume.

Operational Gains: A family-owned restaurant reduced transaction times by 30%, improved inventory accuracy by 26%, and increased monthly revenue by 15% after implementing mPOS, thanks to faster service and integrated loyalty programs

Service-Based Businesses: Getting Paid Instantly

Service providers historically struggled with payment collection, often waiting weeks for checks or dealing with inconvenient bank transfers.

On-Site Collection: Plumbers, electricians, cleaners, and other home service providers now use mPOS to collect payments immediately upon job completion. This instant payment capability improves cash flow and reduces administrative overhead.

Consultation Payments: Freelancers and consultants avoid invoicing delays by processing payments during client meetings with mobile POS devices, ensuring faster revenue realization.

Appointment-Based Services: Beauty salons, repair shops, and professional services streamline their payment processes by accepting credit cards and digital wallets on-site, enhancing convenience for both customers and providers.

Events & Marketplaces: Mobility Meets Opportunity

Festival Vendors: Food and merchandise vendors at festivals process high volumes of transactions without needing dedicated internet connections. Many mPOS systems support offline mode, storing transactions locally and syncing once connectivity is restored, ensuring no sales are lost.

Farmers Markets: Local producers use mPOS to accept modern payment methods like contactless cards and mobile wallets while maintaining their artisanal appeal. This capability attracts a broader customer base and increases sales.

Trade Shows: B2B companies can process orders and deposits immediately, improving conversion rates.

Offline Reliability: Many mPOS platforms are designed to handle spotty or unavailable internet connections by securely storing transaction data locally and synchronizing it once the connection is re-established, such as the Z108 handheld POS. This feature is critical for vendors operating in remote or crowded event locations.

Practical Impact Summary

Transaction Speed: mPOS reduces average transaction times by 25-30%, allowing businesses to serve more customers and reduce queues.

Inventory Accuracy: Real-time updates improve stock management by 25% or more, reducing waste and stockouts.

Customer Satisfaction: Faster service and personalized loyalty programs boost satisfaction scores by around 20%.

Revenue Growth: Businesses report average monthly revenue increases of 15% after mPOS adoption due to operational efficiencies and enhanced customer experience.

Setup & Mobility: Minimal hardware requirements and cloud-based management enable rapid deployment for pop-ups, events, and mobile vendors, lowering costs and risks.

Offline Capability: Critical for event vendors and remote businesses, offline mode ensures continuous sales even without internet, syncing data later

Choosing the Right mPOS System

Key Evaluation Criteria: Making the Smart Choice

Selecting an online point of sale system requires balancing features, costs, and your specific business needs.

Cost Structure Analysis:

- Hardware costs (often $0-$300)

- Monthly subscription fees ($0-$50 typically)

- Transaction processing rates (usually 2.5-3% per transaction)

- Hidden fees for chargebacks, monthly minimums, or early termination

Essential Features Checklist:

- Payment method acceptance (cards, digital wallets, contactless)

- Inventory management capabilities

- Analytics and reporting tools

- Receipt printing or digital receipt options

- Multi-user access and permissions

Technical Requirements:

- Compatibility with your mobile devices (iOS/Android)

- Internet connectivity requirements

- Battery life and processing speed

- Integration capabilities with existing tools

Top Providers: The Leading Players

Square: Ideal for micro-businesses and first-time pos system users. Offers free card readers and transparent pricing with no monthly fees for basic service.

Clover Go: Provides flexible hardware options and extensive app marketplace for customization. Popular among restaurants and retail stores.

Shopify POS: Perfect for businesses selling both online and offline, offering seamless inventory synchronization between channels.

PayPal Zettle: Excellent for businesses already using PayPal for online sales, providing unified payment processing across all channels.

VTI POS Solution: For businesses requiring customized pos website integration and advanced features, VTI offers end-to-end solutions with AI integration and extensive partner network support, particularly strong in the Japanese retail market.

Transition Tips: Smooth Implementation

Data Migration Strategy: Export customer lists, product catalogs, and historical sales data from your current system before switching.

Staff Training Plan: Schedule training sessions during slow business periods. Most mobile pos terminal systems are intuitive, but proper training prevents confusion during busy times.

Pilot Testing: Implement your new system in one location or for specific product lines before full deployment.

Backup Planning: Keep your old system available for several weeks as backup while staff adapts to the new mobile as pos workflow.

Frequent Asked Questions (FAQs)

Q1: What is the difference between mPOS and traditional POS?

Traditional POS systems are stationary terminals requiring dedicated counter space and complex installation. Mobile POS runs on smartphones or tablets, offering portability, lower costs, and easier setup while providing the same core payment processing capabilities.

Q2: Is an mPOS system secure for processing payments?

Yes, reputable mPOS providers implement bank-level security, including PCI-DSS compliance, end-to-end encryption, and tokenization. These systems often provide superior security compared to older traditional POS terminals.

Q3: Can mPOS work without internet access?

Many modern mPOS systems offer offline mode functionality, securely storing transaction data locally and synchronizing with cloud servers once internet connectivity returns. This ensures you never lose sales due to connectivity issues.

Q4: How much does an mPOS system typically cost?

Hardware costs range from free (basic card readers) to $300 for advanced terminals. Software subscriptions run $0-$50 monthly. Transaction fees typically range 2.5-3% per swipe/tap, often lower than traditional merchant account fees.

Q5: Can mPOS integrate with my existing business tools?

Yes, most modern mPOS platforms offer extensive integration capabilities with inventory management, CRM systems, accounting software (QuickBooks, Xero), and e-commerce platforms, creating a unified business management ecosystem.

Conclusion: Embracing the Mobile-First Future

Mobile POS systems represent more than technological upgrades – they’re business transformation tools that align with modern consumer expectations and digital commerce trends.

The Bottom Line Benefits:

- Dramatic cost savings compared to traditional POS systems

- Operational flexibility that grows with your business

- Enhanced customer experiences that drive repeat business

- Access to real-time data for better decision-making

- Future-ready technology that adapts to changing markets

Your Next Step:

The question isn’t whether to adopt mobile pos system technology – it’s which solution fits your specific needs best. Start by evaluating your current pain points, then test different mpos system options to find your perfect match.

The businesses thriving in today’s competitive landscape are those that embrace mobile-first solutions. Your customers are already mobile – isn’t it time your POS system joined them?

Transform your business with mobile POS technology – because your success shouldn’t be tied to one location. VTI provides customized POS solutions with advanced AI integration. Contact us to discuss your requirements!

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)