Is your CFO pushing back on rising IT costs while your operations team reports increasing application downtime? Are board members questioning why competitors seem more agile with leaner technology structures? Meanwhile, organizations struggle to seek specialized expertise that their internal teams lack. Maybe it’s time to outsource your application management. There is undoubtedly an unprecedented interest in the managed application services market.

5 Must-Adapt IT Operations Trend Before 2030

This ebook provides a clear, executive-level perspective on 5 forces redefining IT operations in the next 5 years. The strategic decisions leaders must act now to stay ahead.

Download for Free

And don’t worry. No need to pay thousands of dollars or 200-page documents to get the insights you are looking for.

With this guide, in a few minutes, you’ll gain the intelligence needed for strategy planning, BOD persuasion, or quick vendor evaluation. We’ve consolidated what matters most: the market expansion, Asia regional pricing benchmarks, growing trends that MSPs are expected to have, practical risk mitigation frameworks, and growth projections impacting your 2025-2030 planning horizon.

Consider this your executive briefing – sharp enough to inform immediate decisions, comprehensive enough to validate your team’s analysis.

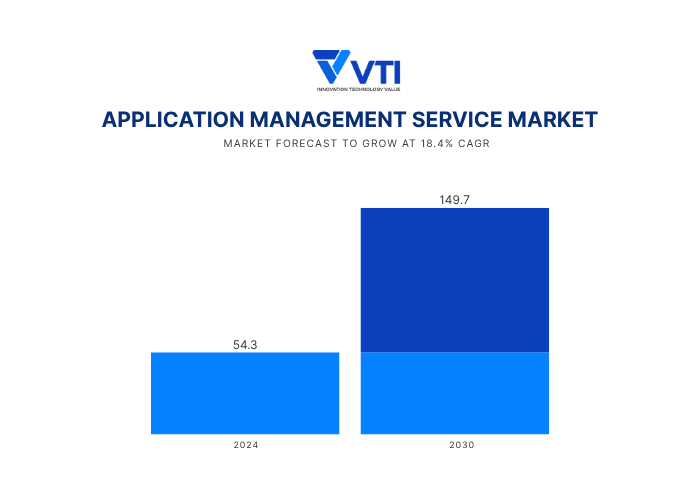

What is the market size of managed application services?

Global Market Valuation and Competitive Landscape

The managed application services market represents one of the fastest-expanding segments in enterprise IT services, defined specifically as ongoing outsourced application hosting, maintenance, monitoring, and support services.

Industry analysts estimate the global managed application services market reached USD 54.3 billion in 2024, with projections indicating growth to USD 149.7 billion by 2030 at an impressive CAGR of 18.4%, according to Globe Newswire.

At a global scale, IBM commands approximately 15% global market share, followed by competitors like Wipro, Accenture, and Capgemini.

Regarding regional vendors, there is also a growing number of trusted managed partners, such as Samsung, Fujitsu, VTI, or Classmethod in Asia.

Such top-tier vendors’ customer retention rates exceed 85%, indicating strong service satisfaction across enterprise clients, partially proving the rightness of outsourcing application management tasks.

Application management services trends also show accelerating adoption across multiple industry verticals, with:

- BFSI representing 28% of market revenue,

- Healthcare accounts for 18%,

- IT/telecom 22% of total demand.

Regional Varied Market Distribution and Maturity

Application performance management market size calculations reveal geographic concentration in North America (42% market share) and Europe (35%); however, Asia-Pacific emerges as the highest-growth region with a projected 22% CAGR through 2030.

But of course, market maturity varies significantly across regions, with established markets like Japan demanding premium services while emerging markets prioritize cost-effective solutions.

For example, Japan has a 65% enterprise adoption rate, while Australia shows a 58% penetration rate among large enterprises.

Meanwhile, Korea and Singapore represent emerging opportunities with 35% and 42% adoption rates, respectively, driven by government digitalization programs and manufacturing automation initiatives.

AMS Pricing Benchmarks in Asia

In general, managed services pricing analysis shows that AMS pricing typically falls within the $50 to $250 per user per month range. The same range can be applied to Application Managed Services.

Yet, it is still hard to say the exact rate for the application management services. Actual costs depend on vendor size, project scope, service tier, and industry requirements.

Diving deeper into Asia-Pacific countries, factors such as labor cost variation between countries, industry expertise, regulatory environment, and service delivery models, the benchmarks vary. Below are some suggested benchmarks by country, compiled from publicly available industry data.

- Japan: AMS hourly rates typically range from $100 to $149, with specialized services occasionally reaching higher. Japan’s premium pricing reflects stringent compliance standards and high service quality expectations.

- Australia: Providers charge approximately $80 to $150 per hour, driven by a mature IT outsourcing ecosystem and advanced infrastructure.

- Singapore: AMS hourly rates are generally between $50 and $100, depending on service complexity and vertical specialization.

- South Korea: While specific data is limited, market trends suggest pricing is comparable to or slightly below Singapore, generally estimated at $50 to $85 per hour.

It’s important to note that pricing models vary across providers. Some vendors charge based on hourly rates, others use per-user, per-device, or tiered monthly bundles. These differences can lead to significant pricing variations within the same region or industry.

Download Free MSP Cost Estimator Template

A simple, powerful template to calculate your managed service expense. Just input your design market, service scope, device count, and support levels, and instantly get your Cost Per Ticket and country-specific benchmark.

Get Free Template

What are emerging trends shaping the managed application services market?

Overall, the managed application services market trends indicate a fundamental shift from traditional break-fix models toward proactive, outcome-driven service delivery that prioritizes business continuity and performance optimization.

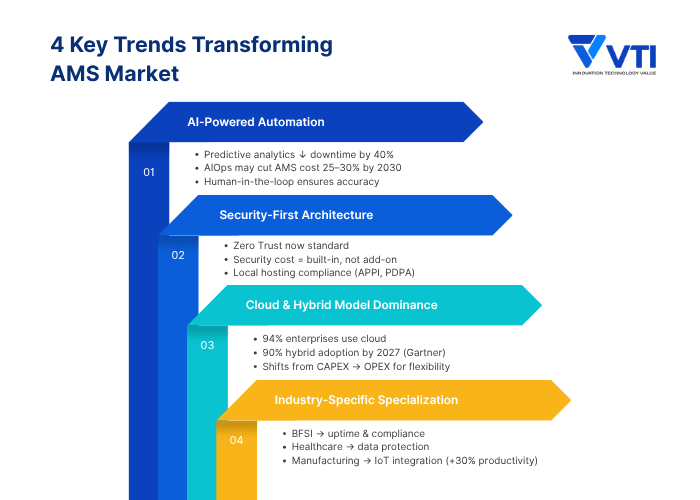

Among all, there are 4 key trends that any enterprise should pay attention to, to ensure the best out of application managed services:

- Hyper-automation application management with AI

- Increasing priority for Security

- The preference for Cloud and Hybrid Model

- Requirement for Industry-Specific Specialization AMS

AI-Powered Automation Transforms Service Delivery Models

Artificial intelligence integration represents the most significant trend reshaping application management services market dynamics, fundamentally changing how providers deliver value to enterprise clients.

Intelligent monitoring tools are replacing manual oversight processes that previously required extensive human intervention. It is reported that machine learning can now predict application failures before they occur, reducing downtime by up to 40% while optimizing resource allocation across complex IT environments.

Not to mention, thanks to automation and intelligent monitoring tools, AIOps adoption may reduce AMS costs by approximately 25–30% by 2030, as tasks like incident resolution, performance tuning, and capacity planning become more automated.

Furthermore, natural language processing enables automated incident resolution for common application issues, freeing technical teams to focus on strategic initiatives rather than routine maintenance tasks.

Despite those advantages of AI, it is worth noting that AI models are still facing problems, like knowledge hallucination. Therefore, human-in-the-loop (AI-powered process with human interference) in managed service is more preferred than a 100% AI-handling system

Key takeaways: Predictive analytics capabilities have become standard offerings rather than premium add-ons. Don’t forget this in your vendor checklist.

Security-First Architecture Becomes Market Standard

Cybersecurity integration has fundamentally transformed how enterprises evaluate managed application services.

Organizations now demand comprehensive threat protection, which was previously sold as separate offerings, built directly into service delivery frameworks from day one. Zero-trust architecture principles now guide application management strategies, requiring continuous verification and monitoring of all access points and data flows.

This reflects evolving enterprise priorities. Protection is now over pure cost optimization, and security overhead costs are becoming standard items in app performance management budget calculations rather than add-ons.

In Asia-Pacific, such data concerns heavily influence markets like Japan and Australia, with demand for locally-hosted solutions that comply with strict data localization requirements (APPI, PDPA,…). This partially explains the dominance of cloud-first or hybrid strategy in enterprise decision-making, with 69% of deployments now favor hosted solutions over on-premise.

Key takeaways: For a client in such an evolving regulatory landscape, it is smarter to look for a vendor with dedicated security knowledge, alongside their core competencies.

Cloud- and Hybrid-based Model Dominance

The migration toward cloud-based application management has reached critical mass, with 94% of enterprises already using a cloud service.

Regarding the hybrid model, 80% of organizations believe this is beneficial to their ability to manage applications and data. According to Gartner’s predictions, the percentage of enterprises using hybrid cloud environments will reach 90% by 2027.

This shift isn’t surprising. It is more assured to maintain control over mission-critical workloads within their private cloud environments.

Hybrid models also help enterprises address demand uncertainties, allowing them to easily scale up or down their IT infrastructure for any sudden changes.

Finally, it is due to its cost-saving potential, with the change in the financial model from Capital Expenditure (CAPEX) to operational expenditure (OPEX).

This trend reflects organizations’ need to balance flexibility, security, and cost control across diverse infrastructure requirements.

Key takeaways: For technology leaders evaluating managed application services providers, cloud expertise becomes non-negotiable. Look for specialized skills in cloud migration, cybersecurity, and regulatory compliance. Also, ask about their experience with hybrid setups and multi-vendor systems, because providers who work across platforms offer smoother integration and help avoid vendor lock-in.

Industry-Specific Specialization Drives Market Segmentation

Vertical expertise becomes increasingly important because regulatory requirements and operational challenges that each industry domain has to address are growing.

In other words, each sector demands different capabilities from its managed services partners. For example:

- Banking and Financial Services face the most stringent requirements. Data security and availability of info updates are critical to the banking and insurance business, mandating high network uptime, rapid fault detection, and quick problem resolution. Providers must navigate complex regulatory frameworks while ensuring seamless process workflows for digital and mobile-first consumers.

- Healthcare organizations require specialized compliance expertise. Information systems storing health information must be safeguarded against unauthorized access.

- Manufacturing is witnessing the IoT integration trend. Toyota utilized IoT for monitoring and analyzing their production lines, achieving a 30% productivity increase, while Honeywell applied IoT solutions in their chemical manufacturing process, successfully decreasing energy consumption by 15%. Therefore, application management must ensure real-time equipment monitoring, predictive maintenance systems, and integration with industrial automation platforms.

Key takeaways: This specialization creates distinct market segments where generic IT expertise is not enough. Looking for providers with demonstrate proven industry credentials and regulatory track records.

Risk Factors and Vendor Management Best Practices

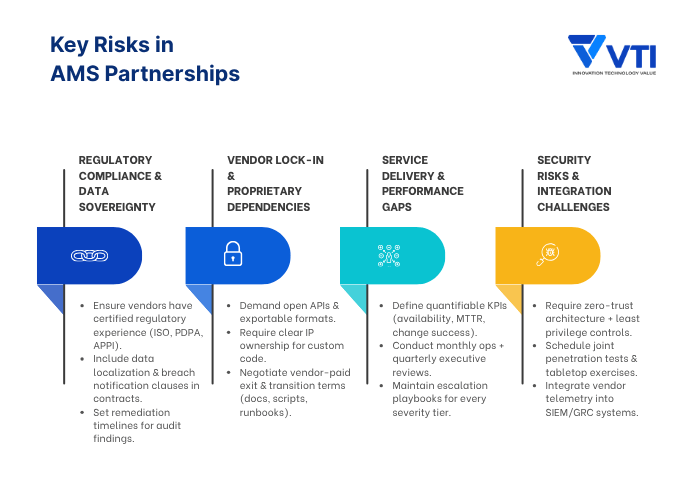

If you are looking for an AMS vendor, below are four risk areas that any leader must treat as strategic – each section explains the risk, practical mitigation steps, and a short “key takeaways – note you can put straight into your vendor evaluation checklist.

1. Regulatory Compliance and Data Sovereignty

Regulation is a moving target across APAC. Non-compliance or unclear data residency controls can lead to fines, audit failures, and loss of customer trust – especially in industries like BFSI and healthcare.

Therefore, it is sensible to choose vendors that can evidence regulatory experience and certifications relevant to your vertical (privacy laws, sectoral guidance, and ISO standards).

Make compliance an explicit contractual obligation: data localization clauses, audit & breach-notification rights, and routine third-party attestations.

During collaboration, insist on demonstrable remediation timelines for any problem findings.

2. Vendor Lock-In and Proprietary Dependencies

Proprietary platforms, undocumented customizations, or unclear IP terms are the silent cost drivers of long-term projects; they decrease your flexibility and make changing vendors slow and expensive.

So, it’s better to require open standards, APIs, and exportable data formats, wherever possible. From full documentation of customizations, configuration exports, and ownership/licensing terms for bespoke code.

In the contract, remember to negotiate exit/transition terms that include vendor-paid knowledge transfer, shadowing periods, and delivery of migration artefacts (runbooks, scripts, test plans).

Just remember: Pay attention to “how” they deliver, not just “what” they deliver. Portability and documented operations will save you future costs.

3. Service Delivery and Performance Gaps

Unclear expectations, vague SLAs, or immature incident processes erode trust and cause measurable business impact that you cannot imagine at the moment.

The strategy here is to define measurable KPIs (availability, MTTR, change success rate, request response times) clearly right at the start. Tie them to remedies and improvement plans if unmatched.

Set a governance cadence: monthly operational reviews, quarterly executive sessions, and defined escalation paths with time-boxed SLAs for each severity tier.

Use joint governance committees to align roadmaps and surface recurring problems before they escalate.

Key takeaways: SLAs are only useful when paired with governance and escalation playbooks — make both mandatory.

4. Security Risks and Integration Challenges

Vendor security weaknesses create immediate risks to your organization. Poor security practices or vulnerable integration points expose you to both cyberattacks and compliance violations.

To protect yourself, build security requirements into your vendor relationships from the start. Ask vendors to demonstrate they use modern security frameworks like zero-trust architecture, least-privilege access controls (granting only the minimum permissions needed), and continuous surveillance of systems for threats.

Moreover, go beyond documentation, make testing a regular practice. Require joint penetration tests (simulated cyberattacks to find vulnerabilities) and tabletop exercises (discussion-based scenario planning sessions) that include vendor teams.

Make sure their security telemetry (automated security data and logs) flows directly into your SIEM (Security Information and Event Management, a system collecting and analyzing security alerts) and GRC (Governance, Risk, and Compliance, tools for managing policies and regulations) systems so you maintain visibility across your entire ecosystem.

Your contracts should guarantee audit rights and require vendors to prove they’ve fixed any vulnerabilities you discover.

Future Predictions for AMS Market Growth

Asia-Pacific Leading Global AMS Market Expansion

Asia-Pacific (APAC) continues to be the world’s fastest-growing region for managed services, including Application Management Services (AMS). According to Grand View Research, the regional managed services market is projected to reach USD 162 billion by 2030, growing at a 15.1% CAGR from 2025 to 2030. The cloud-managed services segment is expanding even faster, expected to hit USD 92.8 billion by 2030 at an 18.7% CAGR.

Growth is fueled by digital transformation across key industries such as financial services, telecommunications, and healthcare. Enterprises are outsourcing non-core operations and IT management to enhance resilience and accelerate modernization.

Within APAC, several markets are standing out:

- Japan is accelerating managed-service adoption as enterprises pursue productivity gains through automation and digital innovation.

- Australia is among the region’s fastest-growing markets for application performance management, driven by demand for reliable cloud infrastructure.

- South Korea is expected to post the highest growth in cloud-managed services, supported by government-backed digital and AI initiatives.

- Singapore continues to advance its Smart Nation agenda, boosting demand for managed services in both the public and private sectors.

Together, these markets illustrate APAC’s momentum toward flexible, scalable IT operations models.

Technology Evolution & Possible Transformation

Rapid technological change is reshaping the AMS landscape. AI-driven automation, predictive analytics, and self-healing systems (a system able to automatically detect, diagnose, and repair malfunctions without human intervention) will soon become baseline capabilities rather than premium add-ons.

Besides, despite not influencing yet, emerging technologies such as edge computing, 5G, blockchain, and quantum computing can potentially create new service categories.

Also, in the future, alongside new providers seeking, vendor consolidation will certainly occur as larger firms acquire niche specialists to not only broaden their digital transformation portfolios but also maintain a high-quality output.

Final words

The managed application services market presents both tremendous opportunities and complex challenges for technology leaders across the Asia-Pacific. With the market growing at 18.4% CAGR and AI-powered automation transforming service delivery, the key to success lies in strategic vendor selection, outcome-based partnerships, and proactive risk management. As pricing models shift toward performance-based contracts and regional markets mature at different rates, understanding these dynamics becomes critical for maximizing your technology investments. Take time to evaluate your current application management strategy against these market trends – the decisions you make today will determine whether you harness this growth wave or get left behind in an increasingly competitive digital landscape.

VTI’s AI-powered Managed Service blends intelligent automation with Human-in-the-Loop expertise. With ITIL-aligned and backed by strong compliance experience, VTI offers flexible operating models and adaptive shift coverage (24/7, after-hours,…) for secure, reliable application operations. Contact us today to explore a customized, AI-driven managed service built around your business needs.

![[FREE EBOOK] Strategic Vietnam IT Outsourcing: Optimizing Cost and Workforce Efficiency](https://vti.com.vn/wp-content/uploads/2023/08/cover-mockup_ebook-it-outsourcing-20230331111004-ynxdn-1.png)